- Pound (GBP) trades higher after Boris Johnson slapped tighter restrictions on England to curb covid

- Manufacturing and Service sector PMI’s to show a slight slowing in growth

- Euro (EUR)under pressure as covid cases grow

- Eurozone & German manufacturing PMI to stronger growth

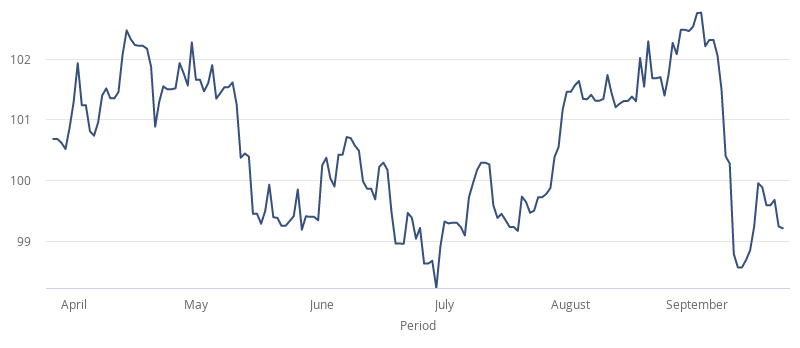

The Pound Euro (GBP/EUR) exchange rate is trading higher on Wednesday, snapping a 4 day losing streak. The pair settled on Tuesday -0.1% at €1.0872. At 05:15 UTC, GBP/EUR trades +0.2% at €1.0893.

The Pound closed lower in the previous session after Boris Johnson tightened restrictions in England in order to prevent the spread of coronavirus. A curfew will be in place for pubs, bars, restaurants and hospitality venues now to be closed by 10pm. He said that these measures could be in place until next Spring. Staff must return to working from home.

The announcement from Boris Johnson comes as the number of coronavirus cases rises by 4926 over the past 24 hours along with 37 new fatalities.

Brexit continues to be in focus as EU Chief negotiator Michel Barnier lands in the UK for informal talks ahead of formal talks which are due to begin on 28th September.

Looking ahead attention now turns to September’s preliminary PMI readings for both the service and manufacturing sectors. Both sectors are expected to show a slight slowing in expansion this month. Manufacturing PMI is expected to print at 54.3 in September, down from 55.2 in August. Meanwhile, the service sector is expected to print at 56, down from 58.8. The level 50 separates expansion from contraction.

The Euro is trading on the back foot across the board on renewed fears over rising coronavirus cases and tighter restrictive measures. The Euro is also suffering at the hands of a stronger US Dollar after upbeat Fed speak in the previous session. The Euro trades inversely to the US Dollar so when the greenback rises, the Euro often comes under pressure.

PMI data from across the bloc will be in focus. German manufacturing activity is expected ri rise slightly in September to 52.5, from 52.2 in August. The Eurozone’s gauge is also seen rising to 51.9 from 51.7. A strong reading would indicate that the bloc is on the road to recovery, boosting the Euro.