The British pound is lower against the US dollar on Friday morning.

- Rebounding UK retail sales sent out good vibes on the UK economy

- UK services and manufacturing PMIs for August beat expectations

- Flash readings for August PMIs for the US could determine next move in USD

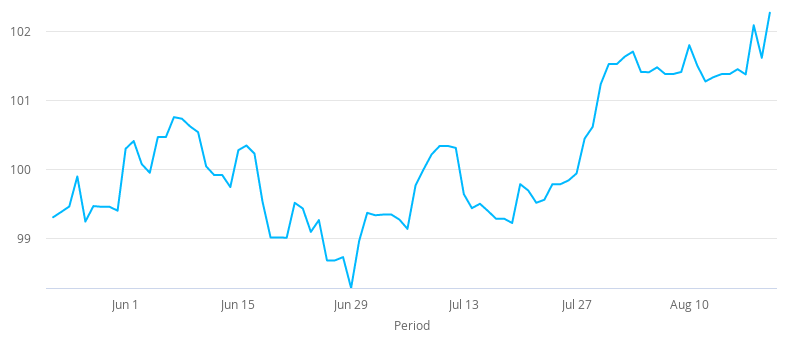

GBP/USD was down by 15 pips (-0.11%) to 1.3197 as of 10am GMT. This week the pound-dollar is up by +0.83%.

The currency pair made early progress to a high of 1.325 but pulled back from there to turn slightly lower on the day, following a big move higher of +0.87% on Thursday.

GBP: Strong data priced in

It has been a roller coaster few days for the cable rate; dropping over 1% on Wednesday and then recovering almost all the losses through Friday morning.

Rebounding UK retail sales sent out good vibes on the UK economy across markets.July retail sales grew 3.6% over the month and were 1.4% higher than a year earlier according to numbers from the Office for National Statistics (ONS).

The improvement came in the month when most major lockdown conditions were eased in the UK, including the reopening of pubs on July 4th. As a consumption-driven economy, signs that consumers were willing and able to go out and spend despite rising unemployment and more difficult social distancing rules to adhere to will encourage economists hoping for a V-shaped recovery.

Sterling began to turn lower not long after services and manufacturing PMIs for August beat expectations. A composite reading of 60.3 easily beat the 57.1 expected but after strong gains in the prior 24 hours, traders took a breather before US data released later.

USD: United States August flash PMIs due later

The US dollar is again attempting some continuation of Wednesday night’s big jump early Friday but whether the strength sees any follow-through could hinge on flash readings for August services and manufacturing PMIs for the US. Expectations are for the services PMI to reach 51 from 50 in July and that manufacturing will reach 51.9 from 50.9 prior.

On Wednesday the Federal Reserve concluded in its meeting minutes that the wave of coronavirus moving across the country was a big risk to the economy. It also decided against spelling out plans for new policy tools should the economic weakness manifest as it predicted. The data released this afternoon will be the first taster for investors about US economic activity since the minutes were released.