- Pound (GBP) advances ahead of a busy week with jobs & GDP data

- 1 in 3 UK employers intend to slash jobs this quarter

- US Dollar (USD) is slipping despite Friday’s stronger than forecast NFP

- US stimulus & US – Sino tensions in focus

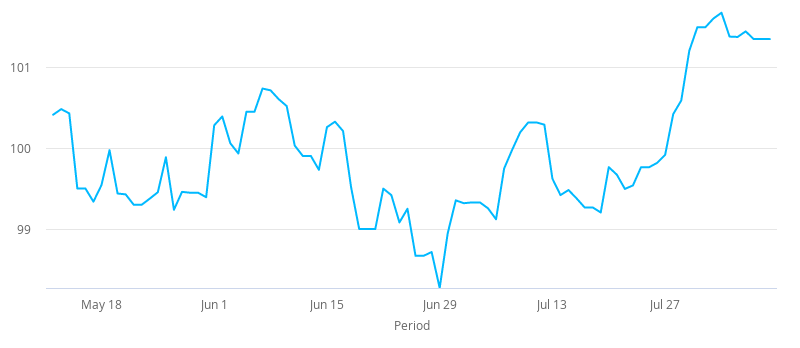

The Pound US Dollar exchange rate (GBP/USD) is pushing higher at the start of the week, after selling off across the previous week. The pair shed 0.3% last week, settling on Friday US$1.3053.

At 06:15 UTC, GBP/USD trades + 0.15% at US$1.3073. This is towards the upper end of the daily traded range.

The Pound is finding support ahead of a key week data wise. Following the less dovish BoE, this week’s key focus will be on the UK GDP due to be released on Wednesday.

Ahead of that the UK labour market report is due tomorrow. It comes as a study by the Chartered Institute of Personnel and Development Department, revealed that one in three employers is looking to lay off staff this quarter. The data highlights to the growing risk of a labour market crisis as the government tapers its support from the furlough scheme.

The US Dollar is struggling to hold onto Friday’s rally following the better than expected US labour market data. The US economy gained 1.7 million jobs in July with the unemployment rate dropping to 10.2%. The data was better than forecast. However, it also shows that the recovery in the labour market is slowing. JOLTS jobs data is due today keeping the US labour market very much in focus.

US fiscal stimulus is acting as a drag on the greenback as the Democrats and Republicans fail to reach an agreement over the US rescue package. President Trump stepped in with executive orders over the weekend and talks will continue in Washington.

US – Sino relations will also be a key driver of sentiment this week as tensions remain elevated. Whilst the White House announced sanctions against Carrie Lam at the end of last week, China has arrested Jimmy Lai, a prominent pro-democracy media mogul – a move which has angered US.

The 2 sides will meet to take stock of the Phase 1 trade deal.