- 1 in 3 employers is looking to cut jobs this quarter

- Brexit optimism keeps Pound (GBP) afloat on quiet data day

- Euro (EUIR) lacks direction ahead of sentiment data

- Concerns rise over EU labour market as governments look to end unprecedented support

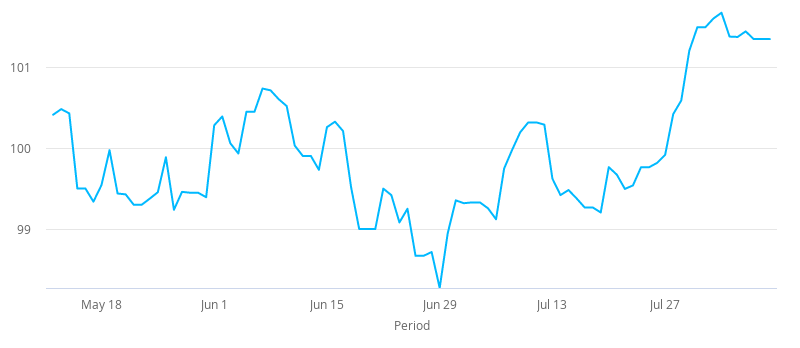

After declining 0.3% across the previous week, the Pound Euro exchange rate (GBP/EUR) is edging higher. The pair settled on Friday at €1.1073. At 05:15 UTC, GBP/EUR trades +0.1% at €1.1082. This is at the top end of the daily traded range.

After the Bank of England’s less dovish than expected comments last week and the upwardly revised GDP outlook for 2020, investors will be looking keenly ahead to this week’s GDP reading and UK labour market data due for release tomorrow.

However, today is a quieter start to the week leaving Pound investors focusing on Brexit optimism and UK – Japan trade deal. Both Rishi Sunak and Michael Gove have both sounded optimistic that a trade deal between the EU and the UK can be reached by September, helping lit the Pound. Japan is still talking trade with the UK too.

Capping any gains on the Pound was a study by the Chartered Institute of Personnel and Development Department, which found that the number of employers expecting to make redundancies has increased from 22% earlier this year to 33% for the three months to the end of September.

One in three employers is looking to lay off staff this quarter. The data highlights to the growing risk of labour market crisis as the government withdraws its support from the job retention scheme.

The Euro is struggling for direction at the start of the new week as investors await sentiment data today and look ahead to Eurozone Q2 GDP data at the end of the week.

The Eurozone Sentix Investor Confidence reading for August is expected to show another improvement reaching -15.2, up from -18.2. The reading comes as concerns over a second wave in Europe start to rise and as fears grow over the state of the labour market amid plans to end the unprecedented support for workers during the coronavirus pandemic.