- Pound (GBP) rises despite manufacturing PMI downward revision

- BoE rate decision tomorrow

- Euro (EUR) falls after yesterday’s weak data

- ECB could cut rates sooner

The Pound Euro (GBP/EUR) exchange rate is rising for a second day. The pair rose 0.22% yesterday, settling on Tuesday at €1.1486 and trading in a range between €1.1420 – €1.1497. At 10:35 UTC, GBP/EUR trades +0.17% at €1.1505.

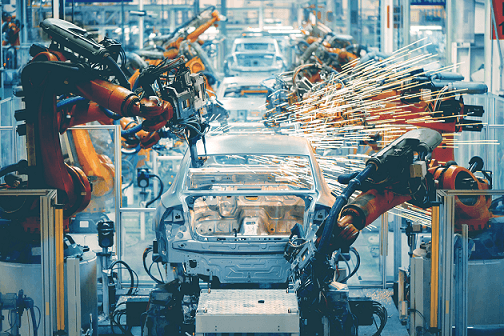

The pound is pushing higher despite data showing that the downturn in UK manufacturing continued at the start of the fourth quarter. The UK manufacturing PMI remained below the level 50, which separates expansion from contraction, coming in at 44.8. This was below the preliminary reading of 45.2 but above September’s reading of 44.2.

Delving deeper into the figures, new orders and employment in the manufacturing sector also showed declines, while business optimism dropped further to a 10-month low.

The data suggests that the UK manufacturing downturn remains a drag on the economy, which could be heading for a recession in the second half of this year.

The data comes ahead of the Bank of England interest rate decision tomorrow, where policymakers are expected to leave interest rates on hold as the economic backdrop deteriorates. However, with inflation still over three times the BoE’s target of 2%, the highest among the world’s richest nations, the Bank of England is likely to reiterate that interest rates will stay high for longer. The hawkish stance is likely even amid growing signs that the economy is stalling and heading for a potential recession.

The euro fell yesterday and is falling further today as investors continue to digest the disappointing growth data from the eurozone and amid expectations that the ECB could start cutting interest rates sooner than expected.

The figures yesterday showed that the eurozone economy unexpectedly contracted in the third quarter of the year after Q2 growth was upwardly revised to 0.2%. Meanwhile, inflation cooled by more than expected to 2.9% year on year in September, down from 4.3% in August. The weaker inflation reading and the economy contracting have raised bets that the ECB could start cutting rates sooner than previously thought.

The ECB left interest rates on hold in its meeting last week after ten back-to-back interest rate hikes. While the central bank suggested that interest rates may need to stay high for longer, the latest data raises questions over that stance.

Today, the eurozone economic calendar is quiet. Parts of Europe observe All Saints day public holiday.