- Pakistan Rupee (PKR) strengthens on improved outlook

- ADB forecasts 2% growth this year in Pakistan

- US Dollar (USD) trades higher versus major peers after strong consumer confidence

- FOMC in focus

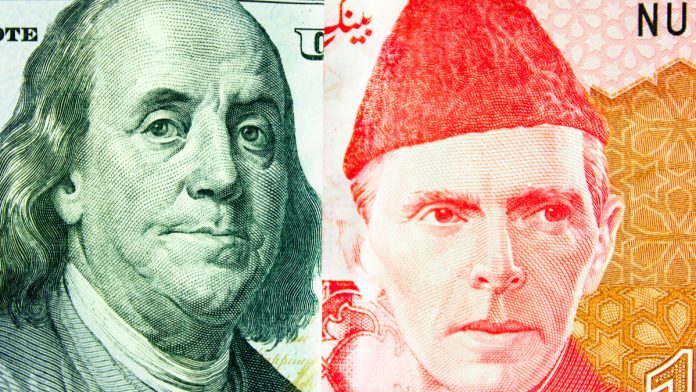

The US Dollar Pakistan Rupee (USD/PKR) exchange rate is moving lower on Wednesday, snapping a 5-day winning streak. The pair settled 0.28% higher on Tuesday at 154.35. At 11:00 UTC, USD/PKR trades -0.5% at 153.48.

The Rupee is advancing following upbeat comments from the Asian Development Bank. According to the Asian Development Bank’s outlook for 2021, Pakistan’s economy will grow by 2% this year as covid restrictions ease.

Should the vaccine programme rollout successfully and measures to stabilize the economy are implemented, economic growth could reach 4% in 2022.

The report considers that industry is poised for robust growth led by manufacturing and construction. Services are also set to rebound as retail and trade pick up.

The Asian Development Bank see inflation easing to 8.7% in 2021.

The US Dollar is falling versus the Rupee but is rising versus major peers on Tuesday. The US Dollar Index, which measures the greenback versus a basket of major currencies trades +0.14% at the time of writing at 91.03.

The US Dollar is extending gains from the previous session after upbeat consumer confidence data and as investors look ahead to the US Federal Reserve monetary policy meeting.

US consumer confidence surged to a 14-month high as increased covid vaccines and additional fiscal stimulus meant more business could reopen. This boosted demand and hiring lifting morale. Households are returning to the shops, eating out traveling and visiting places which should lead to a surge in growth this quarter.

Looking ahead all eyes are on the Federal Reserve which will give its monetary policy decision later today. The Fed is widely expected to keep policy unchanged, even as the US economic recovery picks up. The Fed have said that they would like to see around 75% of the US population vaccinated before they talk of tapering the asset purchase programme.