- Pound (GBP) moves lower after Boris Johnson tightens restrictions

- PMI data to show manufacturing and sector activity expanding at a slightly slower pace

- US Dollar (USD) advances after upbeat comments from Fed Evans

- US PMI data to show steady recovery continuing into September from August

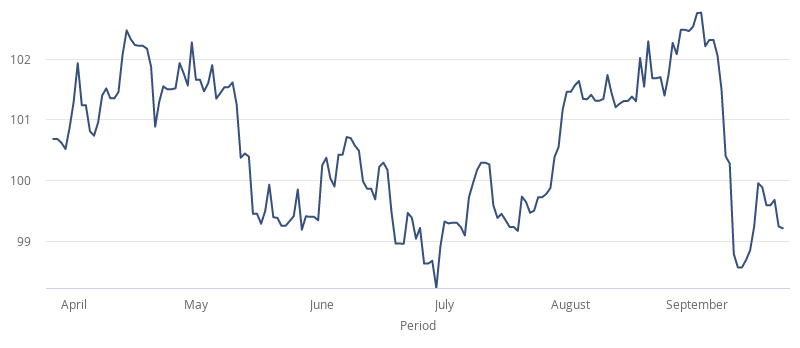

The Pound US Dollar (GBP/USD) exchange rate is extending losses for a fourth day on Wednesday. The pair settled on Tuesday -0.65% at US$1.2731. The pair is has already lost 1.5% so far this week. At 06:15 UTC, GBP/USD trades -0.05% at US$1.2725.

The Pound is under pressure after Prime Minister Boris Johnson tightened restrictions in England in order to prevent the further spread of coronavirus. A curfew will be applied to pubs, bars, restaurants and hospitality venues, with venues to be closed by 10pm. These restrictive measures could be in place until next Spring. Staff must also return to working from home wherever possible.

The Prime Ministers announcement came as the number of coronavirus cases rose by 4926 over the past 24 hours and 37 new fatalities were recorded.

Attention will now turn to September’s preliminary PMI readings for both the service and manufacturing sectors. Analysts expect both sectors to show a slight slowing in expansion this month. The manufacturing PMI is forecast to dip to 54.3 in September, down from 55.2 in August. Meanwhile, the service sector is expected to tick lower to 56, down from 58.8. The level 50 separates expansion from contraction.

The US Dollar went from strength to strength in the previous session. Whilst the US currency rose on safe haven inflows, it also received a boost from Federal Reserve Evans. The markets were surprised when he said that the economy had returned to 90% of pre-pandemic levels and that the Fed could raise interest rates before the 2% average inflation target is reached.

Attention will now turn to US PMI data for both manufacturing sector and the service sector. Analysts are expecting the two sectors to continue expanding at a similar rate in September to that of August. A strong reading could help lift the US Dollar.