- BoE of kept interest rates on hold

- Pound (GBP) rallies after BoE upwardly revises growth forecasts this year and said the recovery has been faster than initially expected.

- US Dollar (USD) trades lower versus major peers amid growing concerns over economic recovery

- Initial jobless claims expected to add to evidence that US job market recovery is stalling

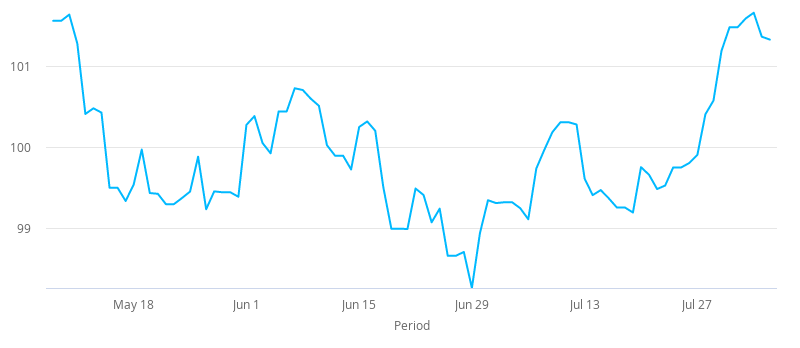

The Pound US Dollar (GBP/USD) exchange rate is surging, extending gains from the previous session. The pair settled on Wednesday +0.4% higher at US$1.3115, off the session high of US$1.3167. At 06:15 UTC GBP/USD trades +0.4% at US$1.3157.

As expected, the Bank of England kept monetary policy on hold with interest rates remaining at the historically low level of 0.1% and the asset purchase programme at £745 billion after being extended by £100 billion in June.

The central bank upgraded growth forecasts with the UK economy now expected to contract -9.5% this year compared to -14% forecast in May. The central bank also said that the economic downturn hadn’t been a deep as initially feared and that the recovery had been faster than expected. The upbeat comments sent the Pound higher.

The US Dollar is struggling versus its major peers on Thursday amid concerns that the US economic recovery could lag that of other countries owing to its high level of coronavirus cases. The same fears dogged the US Dollar in July and the currency experienced its worst monthly performance in a decade.

Data in the previous session painted a mixed picture with ADP private payrolls showing that the US private sector’s labour market was in troubled waters. Whilst the ISM non-manufacturing ISM showed that the US service sector gained momentum. New orders surged to a record high. However, the employment component declined.

Attention will now turn to the U jobless claims data. Analysts are expecting initial jobless claims to decline very slightly to 1.41 million, down from 1.43 million last week. This could add to mounting evidence that the labour market recovery is stalling ahead of tomorrow’s non-farm payroll report.