- Pound (GBP) rises ahead of Brexit talks this week

- The mood surrounding talks is more hopeful

- Euro (EUR) is under pressure amid rising covid cases & lockdown fears

- Consumer confidence data in focus

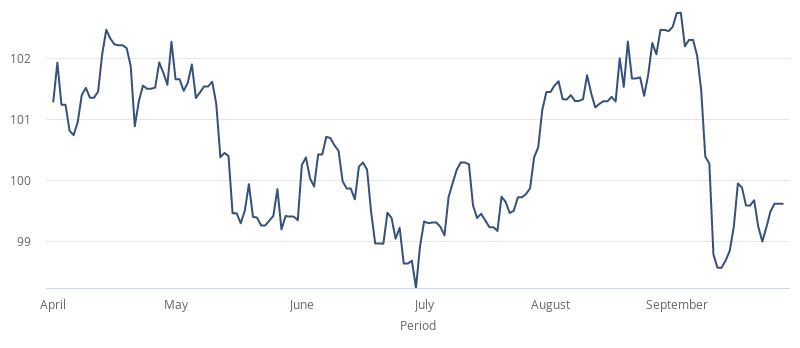

The Pound Euro (GBP/EUR) exchange rate is advancing at the start of the week, adding to gains from the previous week. The pair closed on Friday at €1.0955 with 0.4% gains booked across the week. At 05:15 UTC, GBP/EUR trades +0.2% as the pair targets €1.10.

The Pound is trading cautiously higher as Brexit talks are set to resume this week. The mood music towards Brexit trade talks appears to be improving which is prompting some stability in the Pound. Both Chief EU negotiator Michel Barnier, and EU Commission President Ursula von der Leyen have both adopted a more optimistic stance of a trade deal being agreed.

The clock is definitely ticking, with the British’ government’s self-imposed deadline for a trade deal of 15th October racing closer. Brussels has indicated that it could take legal action against the internal markets bill. However, at the same time they have been careful not to break away from trade talks. Rising coronavirus cases and the growing threat of Scottish independence could tilt the British government towards accepting a deal, this could come at the price of the UK climbing down over state aid.

There is no high impacting data today. All eyes will be on Brexit headlines and rising covid cases.

The Euro has been under growing pressure over he past few weeks as the number of covid cases in the bloc rises sharply particularly in Spain and France. Lockdown restrictions are rising which could threaten to derail the fragile economic recovery.

Lat week, data revealed that business activity unexpectedly contracted in September in the eurozone, as sign of the impact that the second wave is having

Attention today will turn to Eurozone consumer confidence data. The economic sentiment reading is expected to show morale deteriorating.