- Pakistan Rupee (PKR) declines in risk off trade

- Covid cases in Pakistan rising again

- US Dollar (USD) rises on safe haven flows, US fiscal stimulus talks not progressing

- US jobless claims to show stalling recovery

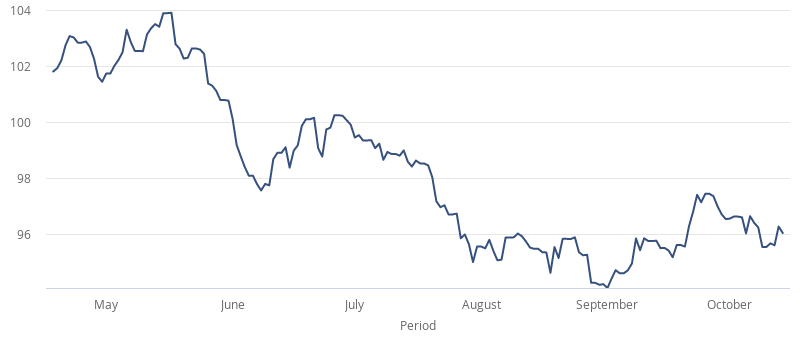

The US Dollar Pakistan Rupee (USD/PKR) exchange rate is pushing higher snapping a two-day losing streak. The pair settled -0.2% lower on Wednesday at 162.51, the low of the day. At 09:15 UTC, USD/PKR trades +0.1% at 162.80.

Risk of trade is dominating the financial markets. Surging covid cases are unnerving investors, who fear that the global economic recovery could quickly be derailed as tighter lockdown restrictions are applied in a bid to stem the spread of the virus.

According to the Minister for Planning and Development Asad Uma, the rate of new daily covid infections in Pakistan has risen to the highest level since August, prompting fears of a second wave. Mr Uma urged people to cooperate with the authorities in following covid precautionary measures or more restrictive actions will need to be taken.

With fears rising investors are selling out of riskier assets and currencies such as the Pakistan Rupee and instead are moving towards safe haven assets and currencies such as the US Dollar.

Adding to the risk off mood are concerns over the absence of additional US fiscal stimulus. Congressional fiscal stimulus talks appear to have little to no progress over the past few days. Recent optimism that the Republicans and Democrats might be able to agree to some form of fiscal stimulus before the US elections is fading rapidly.

With just 3 weeks to go until the US Presidential election, and Joe Biden extending his lead in the polls the Democrats don’t appear willing to give Trump the political victory of a stimulus deal.

Looking ahead US jobless claims will be in focus. The number of Americans filing for unemployment benefit are expected to be 825,000, down just 15,000 from the previous week. With the recovery in the labour market grinding to a halt, the need for additional fiscal stimulus is clear.