- Euro (EUR) trades lower amid soaring covid cases & tighter lockdown restrictions

- EU Summit begins with an assessment on Brexit negotiations expected.

- US Dollar (USD) rises on safe haven flows, US stimulus unlikely this side of the elections

- US jobless claims in focus

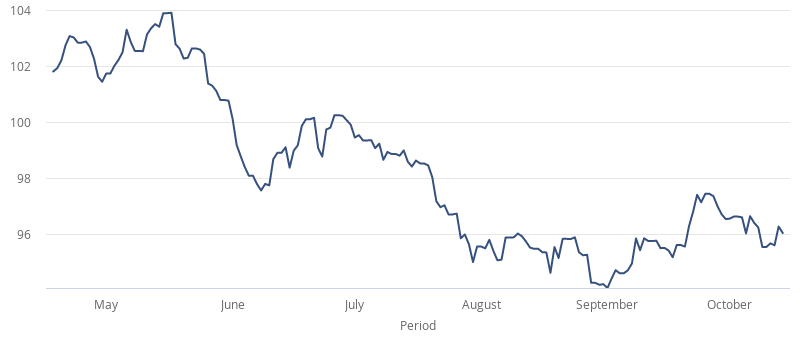

The Euro US Dollar (EUR/USD) exchange rate is edging lower in early trade after finishing flat in the previous session. The pair settled just a few pips higher on Wednesday at US$1.1746. At 07:15 UTC, EUR/USD trades -0.1% at US$1.1732.

The Euro is trading on the back foot as risk off dominates amid rising coronavirus cases across the old continent and tightening lockdown restrictions. France recorded over 22,00 new daily cases and announced a public health national emergency. Paris has been put under a night time curfew for the next 4 weeks. Germany also recorded the highest number of new daily cases since the pandemic started.

Investors fear that tightening restrictions to stem the spread of covid will derail the already very fragile economic recovery. Data this week has clearly shown that the recovery is starting to stall. ZEW German economic sentiment slumped significantly more than expected to 56.1, down from 76, whilst yesterday industrial production figures showed an expansion of just 0.7% in August, down from an upwardly revised 5% in July.

There is no high impacting Eurozone data due today. The two-day EU Summit kicks off today with leaders expected to assess the progress of Brexit talks so far.

The US Dollar is pushing higher as investors seek out its safe haven properties. In addition to the surging number of coronavirus cases, concerns over the absence of any additional US fiscal stimulus is also dragging on risk appetite.

US fiscal stimulus talks appear to be going nowhere fast. Recent optimism that the Republicans and Democrats could agree to some form of fiscal stimulus before the US elections is fading rapidly. With just 3 weeks to go, and Joe Biden extending his lead in the polls it seems that the Democrats are not willing to give Trump the political victory of a stimulus deal.

Attention will now turn to US jobless claims for further clues over the health of the US labour market.