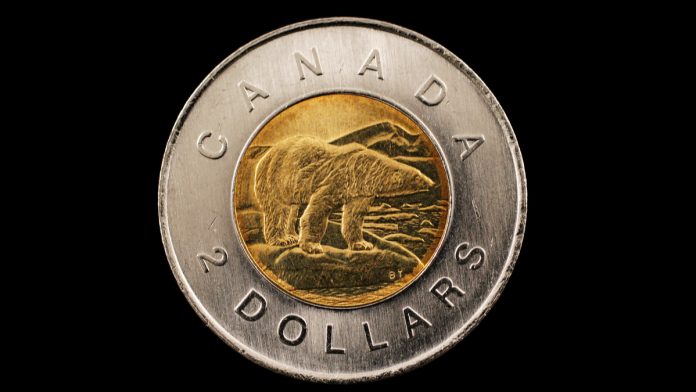

- USD/CAD gained today after sustained weakness in earlier days.

- A sharp fall in the oil prices pulls down the Loonie.

- The risk-off sentiments boost the haven-linked US dollar.

The USD/CAD managed to reverse yesterday’s fall to its one-week low and was trading near 1.3330. The pair had fallen from the two-month top near 1.3420 area in the previous days of the week. The uptick was helped by the dollar strength and oil price weakness.

The US equity selloff pointed to the growing risk-averse sentiments, putting the dollar back in demand, as the US fiscal stimulus bill discussions went nowhere near conclusion even after the renewed efforts in recent days. The market mood got further soured by the news that Trump tested positive for the coronavirus.

The oil prices fell by three Percent as demand worries made a strong comeback without any apparent support for the economy from the policymakers. The black gold prices are on course to hit the second week of declines, after reports of additional supply from OPEC in September, mainly from Libya and Iran.

The dollar pullback will not gain further momentum as the traders are awaiting the Non-Farm Payroll numbers later in the day. Markets expect 850K new jobs in September in the economy, falling from 1.37 million jobs created in the previous month. The unemployment rate might show a reading of 8.2 Percent, from 8.4 Percent previous.

Currencylive.com is a news site only and not a currency trading platform. Currencylive.com is a site operated by Wise US Inc ("We", "Us"), a Delaware Corporation. We do not guarantee that the website will operate in an uninterrupted or error-free manner or is free of viruses or other harmful components. The content on our site is provided for general information only and is not intended as an exhaustive treatment of its subject. We expressly disclaim any contractual or fiduciary relationship with you on the basis of the content of our site, any you may not rely thereon for any purpose. You should consult with qualified professionals or specialists before taking, or refraining from, any action on the basis of the content on our site. Although we make reasonable efforts to update the information on our site, we make no representations, warranties or guarantees, whether express or implied, that the content on our site is accurate, complete or up to date, and DISCLAIM ANY IMPLIED WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE. Some of the content posted on this site has been commissioned by Us, but is the work of independent contractors. These contractors are not employees, workers, agents or partners of Wise and they do not hold themselves out as one. The information and content posted by these independent contractors have not been verified or approved by Us. The views expressed by these independent contractors on currencylive.com do not represent our views.