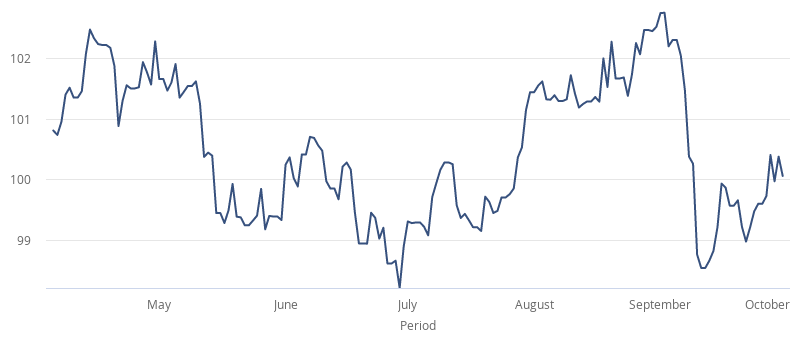

GBP/INR is extending losses in early trading on Friday, after falling by 0.72% yesterday. At the time of writing, one British pound buys 94.281 Indian rupees, down 0.06% as of 6:50 AM UTC. Still, the pair is set to end the week higher thanks to a three-day rally that started on Monday.

In India, markets are closed today in observance of Mahatma Gandhi Jayanthi holiday.

The pound started to lose momentum yesterday when the EU launched legal action against the UK over its Internal Market Bill, which passed the lower house of parliament earlier this week. The EU argued that the UK’s new bill undercuts Britain’s legal commitments as stipulated in the Withdrawal Agreement treaty.

Such infringement may lead to huge fines being imposed by the European court. However, the process is rigorous and may take years, leaving Boris Johnson’s government enough time to take a step back.

The UK should reply to the letter of complaint from the European Commission until November. The EU will then analyze the answer and may require Britain to act according to previous agreements. If the UK fails to do that, the EU may sue at the European Court of Justice.

UK Stands By Its New Bill

The UK said that it had already explained why it chose to introduce the new Internal Market Bill, citing the sensitive border issue between Northern Ireland and Ireland, which is an EU member. A UK government spokesperson stated:

“We need to create a legal safety net to protect the integrity of the UK’s internal market, ensure ministers can always deliver on their obligations to Northern Ireland and protect the gains from the peace process.”

The conflict comes amid the last round of negotiations between the two, as Johnson moved the deadline from December to October 15.

Meanwhile, the sterling couldn’t leverage manufacturing activity data, which fell short of expectations. UK factory activity increased for a fourth straight month in September, though at a slower pace than in August. IHS Markit said that manufacturing purchasing managers index (PMI) fell to 54.1 from 55.2 in August, while analysts expected a decline to 54.3. The 50 mark separates growth from contraction.