- Pound (GBP) is under pressure on Brexit concerns

- Manufacturing OMI showed growth eased in September

- Euro (EUR) advanced after manufacturing expansion picked up pace

- Euro looks to inflation data

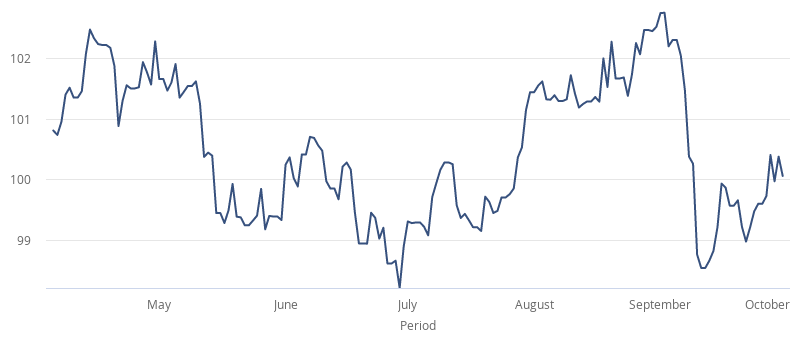

The Pound Euro (GBP/EUR) exchange rate is advancing on Friday, paring some losses from the previous session. The pair experienced a volatile session on Thursday before settling -0.45% lower at €1.0968. At 05:15 UTC, GBP/EUR trades +0.1% higher at €1.0980. Heading towards the weekend, the pair is looking to end the week +0.2% higher. Across the month of September, the pair trades -1.6%.

The European Commission announced that it would send a letter of formal notice to the British government for breaching the Brexit Withdrawal Treaty. Meanwhile the 9th round of trade talks continues.

How much progress has been made in the trade talks depends largely who you speak with? EU officials have urged caution on the progress of the negotiations even after some UK officials spoke optimistically of a breakthrough in discussions.

Several EU officials have said that they don’t expect to enter “the tunnel” a period of very intense final negotiations next week. Some EU officials warned that that wouldn’t happen even next week whilst other suggest that tunnel talks might not even be entered into until after the summit on 15th and 16th October.

Data is the previous session added to the downbeat mood towards the Pound. IHS/Markit manufacturing PMI showed the activity eased slightly in the sector from 54.1 in September from 55.2 in August.

With no high impacting data, Brexit headlines will drive the Pound.

The Euro traded higher versus the Pound in the previous session, after data revealed that the manufacturing sector growth picked up pace in September as a resurgence in exports boosted output. The PMI rose to 53.7 in September, up from 51.7.

Attention will now turn to Eurozone inflation data which is due. Earlier in the week European Central Bank President Christine Lagarde warned of low inflation in the bloc. Analysts are expecting the disinflation to continue with -0.2% inflation expected month on month in September.