- Euro (EUR) under pressure as covid cases rises & lockdown restrictions tighten

- No Eurozone data to distract investors

- US Dollar (USD) broadly under pressure on improving market mood

- US lawmakers restart talks on covid fiscal stimulus

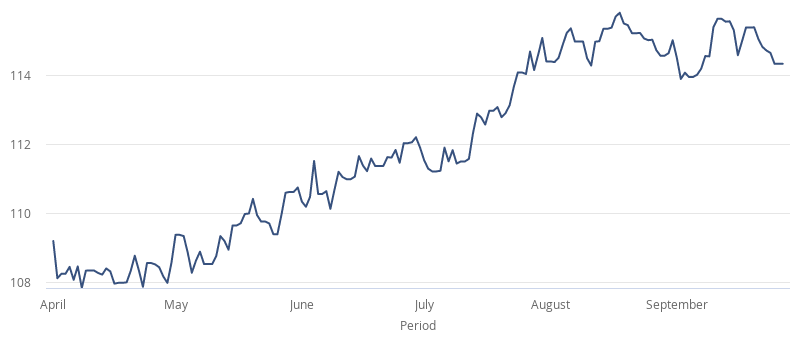

The Euro US Dollar (EUR/USD) exchange rate is holding steady at the start of the week, after experiencing losses of 1.7% across the previous week. The pair closed on Friday at US$1.630, close to the week’s low of US$1.1612. At 07:15 UTC, EUR/USD trades just a few pips lower at US$1.1627.

The Euro was under pressure last week and continues to trade lower versus most its major peers as investors fret over the rising number of coronavirus infections and the threat posed to the fragile economic recovery.

Last week data showed hat business activity in the region unexpectedly contracted in September. With covid cases rising and more local lockdowns being put in place, the outlook for the bloc is deteriorating. Spain and France are seeing a sharp rise in infections. Spain recorded 12,272 new cases on Friday taking the total to 716,481 – the highest infection tally in Europe. Meanwhile France recorded 14,412 new cases on Saturday. Additional lockdown measures are almost certain in the coming days and weeks.

Attention will now turn to consumer confidence data tomorrow which is expected to deteriorate in the service sector but not surrounding manufacturing.

The US Dollar is easing lower versus its major peers, even if it holds steady versus the Euro. An improved mood in the market is dragging on demand for the safe haven US Dollar.

Late on Friday the US Treasury Secretary Steve Mnuchin and House Speaker Nancy Pelosi agreed to restart formal talks on a new coronavirus fiscal stimulus package. This is boosting optimism in the market. There had been growing fears that with the US elections under 2 months away the two sides would struggle to reach an agreement on a rescue package.

Adding to the upbeat mood was stronger data from China overnight. Factory profits rose for a 4th straight month, indicating that the economic recovery is picking up momentum in the world’s second largest economy.