- Pound (GBP) trades higher as hopes of a Brexit deal rise

- The UK negotiating team reportedly said there will be a deal

- US Dollar (USD) trades broadly higher ahead of busy week

- US Consumer confidence & Fed speak in focus

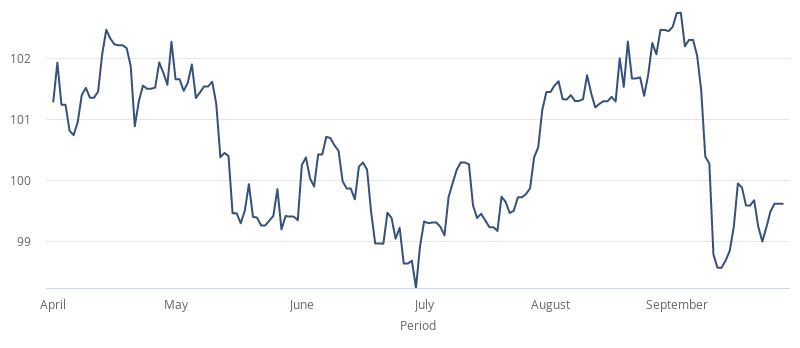

The Pound US Dollar (GBP/USD) exchange rate is moving higher at the start of the week, paring at least some of the 1.3% losses from the previous week. The pair closed on Friday at US$1.2745, off the week’s low of US$1.2674. At 06:15 UTC, GBP/USD trades +0.2% at US$1.2770.

Brexit optimism is lifting the Pound. Despite the Internal Markets Bill hanging over the new round of talks, the UK negotiating team is reported to have said that here will be a deal. Adding to the upbeat mood music surrounding the talks the Confederation of British Industries head, Carolyn Fairbairn has also indicated that a deal can be reached.

According to the Financial Times, the cost of not agreeing a trade deal is expected to be in the region of a million jobs and additional strain to the UK economy which has yet to overcome the pandemic impact.

Brexit aside, the UK is experiencing a sharp rise in covid cases, up 46% in just a week. Fear are growing that London will be in lockdown with pubs and restaurants closing in potentially a matter of days.

In the absence of any high impacting data, Brexit headlines will be key, as Michael Gove visits the European Commission Vice President Maros Sefcovic.

The US Dollar is trading lower versus the Pound, and is continuing to pull back versus other major peers on optimism over US fiscal stimulus and China’s economic recovery.

This week is a busy week datawise and politically ahead of the first live debate on Tuesday between Trump – Biden in the race to the White House. Few people are ready to bet on the outcome of the Presidential Election, however they might be ready after tomorrow’s debate.

Today, US consumer confidence data and a slew of Fed speakers could drive the greenback.