- Indian Rupee (INR) rises as China & India agree to halt troop deployment to Himalayan border

- Indian covid cases surge again

- US Dollar (USD) well supported following upbeat Fed comments

- US service sector & manufacturing PMI in focus

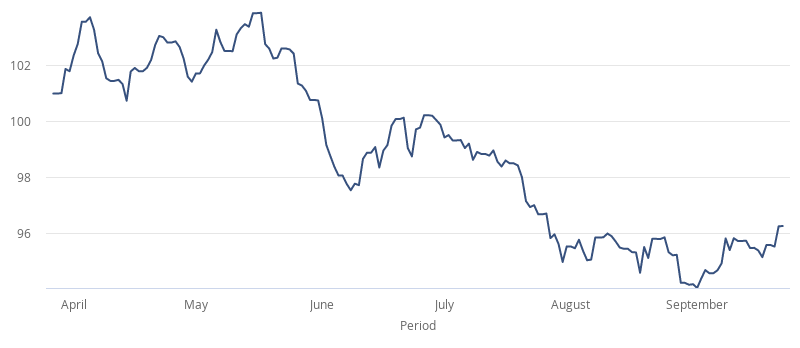

The US Dollar Indian Rupee (USD/INR) exchange rate is extending losses for a second straight session. The pair settled mildly lower -0.08% at 73.51 on Tuesday. At 11:30 UTC, USD/INR trades -0.07% at 73.45, this is at the lower end of the daily range.

Both India and China have agreed not to send more troops to the disputed boarder region in the Himalayas, in an attempt to avoid situations or actions that could complicate an already very tense situation. The update comes after weeks of rising tensions over the ill-defined border. The easing of geopolitical tensions between the two nuclear powers is being seen as a positive development.

Coronavirus concerns are capping any gains in the Rupee as India’s covid-19 cases surge after a recent dip. On Tuesday new daily infections eased back to the lowest level in almost a month. However, today a further 83,347 cases were reported, with deaths reaching 1,085.

The spread of covid in India continues almost unabated, consistently reporting the world’s highest number of daily infections. With an overstretched health system, efforts to control the pandemic are failing. The longer that the virus continues at such elevated levels the harder the economic hit and the deeper the economic scars.

The US Dollar is trading steadily versus its major peers after gaining strongly in the previous session. Upbeat comments from Federal Reserve officials in the previous session helped lift the US Dollar to a 2 month high versus a basket of 6 major peers (US Dollar Index).

Fed official Charles Evans was very bullish saying that the US economy had returned to 90% of pre-pandemic levels. He added that the Fed could raise interest rates prior to the 2% average inflation target being reached.

US PMI data will now move into focus. Analysts are expecting service sector activity to ease back slightly in September, but manufacturing pick up its expansion.