- Pound (GBP) shows resilience with a glimmer of Brexit hope

- Rising covid cases could limit any gains

- Euro (EUR) trades under pressure as economic recovery shows signs of slowing

- Eurozone consumer confidence in focus on Tuesday

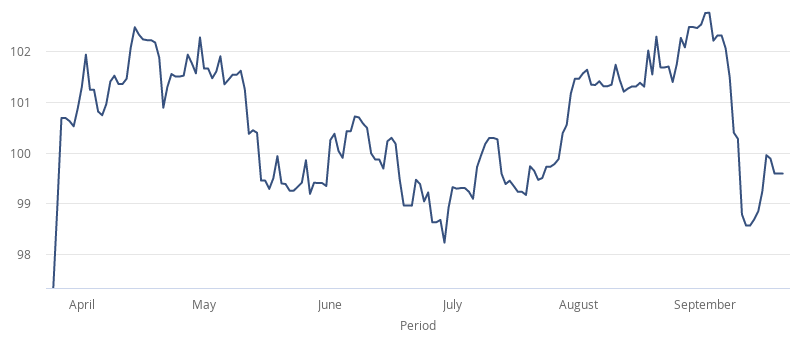

The Pound Euro exchange rate (GBP/EUR) is pushing higher on Monday, extending gains from the previous week. The pair settled on Friday up 1% across the week at €1.0907, down around 100 points from the weekly high of €1.1011. At 05:15 UTC, GBP/EUR trades +0.2% at €1.0922.

The Pound managed to climb higher across the previous week on slight Brexit optimism and despite the Bank of England taking a step closer towards negative interest rates.

Prime Minister Boris Johnson’s controversial Internal Markets Bill passed through its first vote in Parliament last week, in a worrying move for the Pound. However, Boris Johnson climbed down, compromising with Conservative MP rebels to grant Parliament a greater oversight role in applying the law. Whilst Brussels has yet to respond, Pound traders feel that it is at least a move in the right direction.

Other upbeat Brexit comments from EU chief negotiator Michel Barnier and EU Commission President Ursula von der Leyen that a deal is still possible has helped to underpin the Pound amid the Brexit drama.

Brexit aside, coronavirus fears are returning as new daily infections continue to climb steeply and as talks of more localised lockdown, or even a two-week circuit breaker lockdown gain momentum. According to Chris Whitty, the government’s chief medical officer the UK is at a critical point as the infection rate heads in the wrong direction.

The Euro was under pressure across last week as concerns over the rising number of coronavirus infections and the economic recovery in the bloc pick up. Recent data has shown that the economic rebound is starting to slow considerably. Economic activity remains well below pre-pandemic levels.

Inflation is a big headache for the European Central Bank as it remains depressed – 0.2%, year on year in August.

There is no high impacting Eurozone data due for release today. Investors will look head towards tomorrows Eurozone consumer confidence numbers and Wednesday PMI figures for September.