- Large Scale Manufacturing grows by 5% YoY in August

- Oil surges over 5% in 2 days on inventory build & hurricane Sally disruption weighing on Pakistan Rupee (PKR)

- US Dollar (USD) looks ahead to Fed rate decision, no changes in policy expected

- US retail sales to show +1.1% increase MoM as economic recovery continues

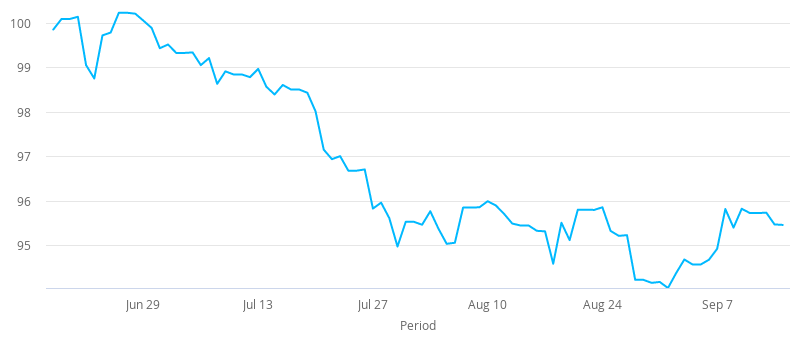

After slipping lower in the previous session the US Dollar Pakistani Rupee (USD/PKR) exchange rate is trading higher on Wednesday. The pair settled -0.15% on Tuesday at 165.39. At 09:30 UTC, USD/PKR trades +0.6% at 166.38.

According to the Pakistan Bureau of Statistics Large Scale Manufacturing growth increased by 5% in July compared to the same period the year before and jumped 9.5% across June compared to June 2019.

Rising oil prices are adding pressure to the Rupee. Oil has rallied over 5% across the past two days after the American Petroleum Institute (API) recorded a significant draw in inventories -9.5 million barrels vs 2.04 million increase expected and amid production disruptions in the Gulf of Mexico due to Hurricane Sally

The US Dollar is trading higher versus the Rupee. However, it trades cautiously lower versus its major peers ahead of the Federal Reserve’s monetary policy announcement at 18:00 UTC, today. The US central bank is expected to keep monetary policy unchanged. They could provide more clarity on the shift to a more lenient approach to inflation, targeting an average of 2%. Federal Reserve Chair Jerome Powell announced this shift in policy framework at the Jackson Hole symposium in August.

The Federal Reserve will also release updated economic projections, which will be closely monitored, as will the dot plot. The dot plot maps out the Federal Reserve’s expectations for rates. The dot plot could be moved lowered to reflect the Fed’s change in approach to inflation, allowing an overshoot of the 2% target to make up from periods under the 2% level.

Before the Federal Reserve’s rate announcement US retail sales will be released. Expectations are for a 1.1% rise in August compared to the previous month, just slightly down from 1.2% the previous month.