- Pound (GBP) lifted after UK makes concessions on fisheries in trade talks

- UK inflation data expected +0.4% MoM

- Euro (EUR) well supported since ECB meeting

- German ZEW investor sentiment unexpectedly improved in September

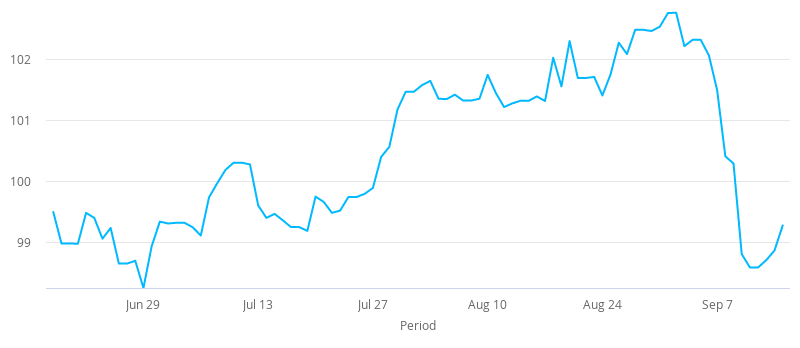

The Pound Euro (GBP/EUR) exchange rate is trading higher for a third straight session. The pair settled on Tuesday +0.5% at €1.0876. At 05:15 UTC, GBP/EUR trades +0.1% at €1.0891.

After losing -3.5% across the previous week, GBP/EUR has clawed back +0.9% so far this week.

Brexit remains a key driver for the Pound. Last week the Pound plummeted as UK PM Boris Johnson made plans to undercut the Brexit divorce treaty through the internal markets bill. The bill cleared its first vote in Parliament this week and will continue to be debated across the week. Although the Pound appears less concerned.

Brexit trade talks continue and Britain reportedly offered concessions on fisheries with the EU, in an attempt to overcome a key obstacle in talks which have been deadlocked for months.

Attention now will move to the economic calendar and the release of UK inflation data. Inflation as measured by the consumer price index is expected to rise +0.4% month on month in August. On an annual basis CPI is expected to rise 1.3%, up from 1% in July. Meanwhile core inflation, which excludes more volatile items such as food and fuel is seen slowing to +1.4% year on year in August, down from 1.8%.

The data comes ahead of the Bank of England’s monetary policy announcement on Thursday.

The Euro trades lower versus the Pound, however it has been showing resilience versus its other major peers following the European Central Bank meeting last week. The ECB appeared unfazed by the recent appreciation of the common currency.

Better than forecast German ZEW data also under pinned the Euro in the previous session. The data revealed that investor sentiment in Germany rose unexpectedly in September despite headwinds from Brexit talks and rising coronavirus infections. This bodes well for the economic recovery in the Eurozone’s largest economy.

There is no high impacting Eurozone data today.