- GBP/USD Holds on to early gains after the UK retail sales numbers.

- The US dollar selling bias helps the pair.

- UK flash PMI eyed for further direction.

The GBP/USD traded flat around 1.3240-50 after the release of the upbeat UK sales figures, holding on to the gains made early in the day. The pair’s start-of-the-day strength was in continuation of its 150 pips bounce yesterday from the weekly lows around 1.3065.

The fresh selling in the dollar after the FOMC-bounce helped the pair to rally back even before the better-than-expected UK Retail Sales figures.

Headline sales came in with a growth of 3.6 Percent in July, beating the two Percent increase expected by the market. The core retail sales – excluding fuel sale -beat the consensus of 0.2 Percent, by jumping two Percent in July.

The UK retail sales on an annualized basis stood at 1.4 Percent in July compared to a flat reading consensus; core retail sales rose 3.1 Percent – another surprising number for the traders.

US dollar bears tightened their grip, as the economy worries gained strength after the US Initial-Jobless-Claims spiked above one million in a weekly report.

FOMC meeting minutes earlier to this had also shared worries about the hiring slowdown.

The greenback has another paint point in the uncertainty over the next round of fiscal stimulus. The stimulus is dependent on the passage of the bill now stuck in a political jam in the US Congress.

GBP/USD might strengthen further as these worries play out in the US dollar. The pair now waits for the flash version of the UK PMI prints for further action.

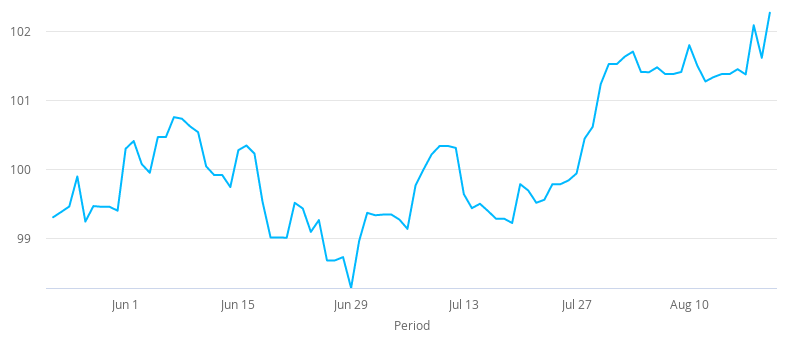

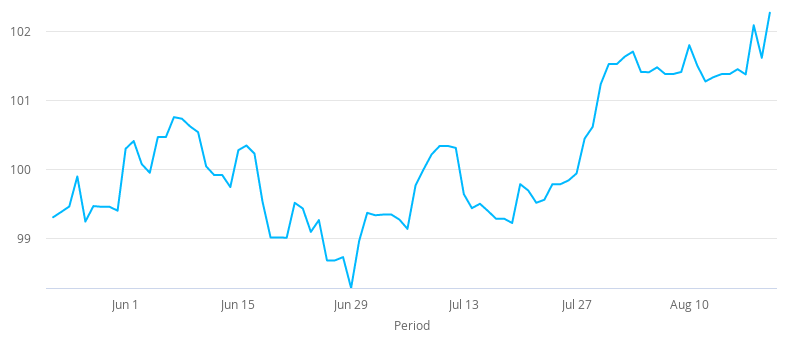

GBP Index Today - last 90 days

Currency Index charts show the

strength of a single currency based on a basket of foreign currencies. This is done using a weighted mean (an average) of the 5 largest routes from that source currency and their daily FX rates. You can explore

live exchange rates here.

Currencylive.com is a news site only and not a currency trading platform. Currencylive.com is a site operated by Wise US Inc ("We", "Us"), a Delaware Corporation. We do not guarantee that the website will operate in an uninterrupted or error-free manner or is free of viruses or other harmful components. The content on our site is provided for general information only and is not intended as an exhaustive treatment of its subject. We expressly disclaim any contractual or fiduciary relationship with you on the basis of the content of our site, any you may not rely thereon for any purpose. You should consult with qualified professionals or specialists before taking, or refraining from, any action on the basis of the content on our site. Although we make reasonable efforts to update the information on our site, we make no representations, warranties or guarantees, whether express or implied, that the content on our site is accurate, complete or up to date, and DISCLAIM ANY IMPLIED WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE. Some of the content posted on this site has been commissioned by Us, but is the work of independent contractors. These contractors are not employees, workers, agents or partners of Wise and they do not hold themselves out as one. The information and content posted by these independent contractors have not been verified or approved by Us. The views expressed by these independent contractors on currencylive.com do not represent our views.