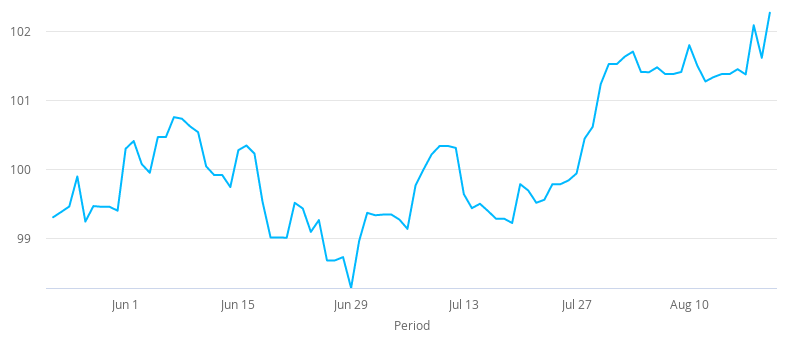

GBP/INR is correcting in early trading on Friday, after surging over 1% yesterday. Still, the pair is set to conclude an impressive week that saw it updating the highest level in more than four years during the Thursday session. At the time of writing, one British pound buys 99.000 Indian rupees, down 0.11% as of 7:30 AM UTC. The price has formed a double top pattern, suggesting that the correction might last longer this time.

The fundamentals for the pound are mixed, so the next moves depend very much on investors’ mood. Yesterday, the UK reported almost 1,200 new COVID-19 cases, the second-highest daily figure since June 21. However, that reflects the sudden increase in testing. Still, that doesn’t bode well for the pound, which is retreating against the rupee after touching 99.297.

Also, Britain’s public debt exceeded 2 trillion pounds for the first time ever in July, as the government led by Prime Minister Boris Johnson boosted public spending to address the pandemic. Net debt, which doesn’t touch upon public banks, increased to 2.004 trillion pounds, which is the equivalent to 100.5% of the UK’s gross domestic product (GDP) – the highest in almost 60 years.

Finance minister Rishi Sunak commented:

“Today’s figures are a stark reminder that we must return our public finances to a sustainable footing over time, which will require taking difficult decisions.”

UK Retail Sales Beat Forecasts

On the positive side, British retail sales jumped to exceed their pre-COVID levels in July, which was the first full month when non-essential stores were open since the lockdown came into effect. Retail sales increased by 3.6% compared to June, beating all forecasts. The indicator rose 1.4% compared to July 2019.

Alistair McQueen, head of savings and retirement at Aviva, commented:

“This uptick in retail consumption may help ease concerns over the fragility of the UK economy – but not for long.”

The UK’s retail sector experienced a much faster rebound than the rest of the economy affected by the lockdown. Online shops and e-commerce platforms were the big winners during the last few months.