- Pound (GBP) rises from overnight lows despite a record GDP contraction in Q2

- UK labour market is showing signs of weakening after ¾ million have lost their job from March – June

- US dollar (USD) trades broadly higher on hopes of an economic recovery

- US inflation expected to stabilise in July, increasing 0.2% month on month

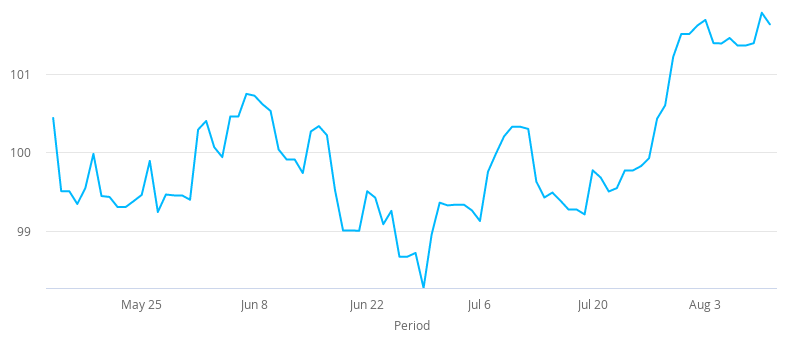

The Pound US Dollar (GBP/USD) exchange rate is attempting to push back over the flatline on Wednesday. The pair settled in the previous session -0.17% at US$1.3048, well down from the session high of US$1.3132. At 06:15 UTC, GBP/USD trades -0.05% at US$1.3040.

The UK economy contracted by a record -20.4% quarter on quarter in the April – June period, reflecting the full impact of the coronavirus lockdown on the economy. This was marginally better than the -20.5% forecast. However, rather than focusing on the past, investors opted to cheer the better than forecast 8.7% month on moth GDP expansion in June, which showed a solid economic recovery was on track.

The data comes after figures from the Office of National Statistics revealed that the UK shed almost 750,000 jobs since the start of the coronavirus lockdown in the UK. The numbers could get much worse over the coming months as the British government withdraws its support from the job retention scheme. The ONS said that 5 million employees were still on furlough in June, these people are at risk of losing their job in the coming weeks or months.

The US Dollar is advancing versus its major peers on Wednesday for a second straight session with rising hopes of a US economic recovery lifting US treasury yields and the US Dollar.

In the previous session, US Producer Price Index, which measures inflation at wholesale level increased 0.5% month on month in July. This was significantly up from June’s -0.3% decline and ahead of analysts’ expectations of 0.1% increase.

The upbeat data comes after US non farm payroll impressed last week and data so far this week has also surprised to the upside, suggesting that he rise in covid cases hasn’t hampered the US economic recovery, so far.

Attention will now turn to US consumer inflation. The consumer price index is expected to stabilise in July after collapsing in March and April and recovering across the three following months. A month on month increase of 0.2% is expected in July, in line with June’s reading.