- 730,000 people have lost their job in the UK since March as fears surrounding the UK labour market grow

- Pound (GBP) investors look to UK GDP data, which is expected to show -20.5% contraction

- Germany ZEW data shows sentiment in Europe’s largest economy increased sharply in July as recovery hopes grow, boosting Euro (EUR)

- Eurozone industrial production to jump +10% mom adding to upbeat data releases for the bloc

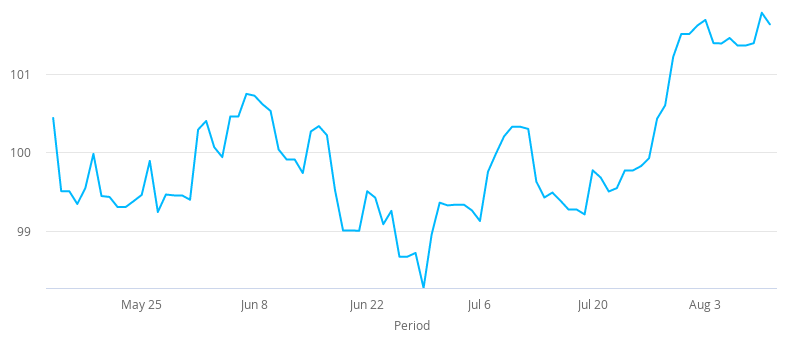

The Pound Euro exchange rate (GBP/EUR) is edging cautiously higher on Wednesday as it looks to pare some losses from the previous session. The pair settled on Tuesday -0.15% €1.1113. At 05:15 UTC, GBP/EUR trades +0.05% at €1.1118.

The Pound ended lower in the previous session after data showed that the number of people in work in the UK experienced its largest decline since the financial crisis. Serious cracks in the labour market are starting to show as the government begins to taper its support, raising concerns that a labour market crisis could derail the economic recovery.

730,000 people have lost their job since the start of lockdown and this number is expected to get much worse as the government withdraws from the job retention scheme between now and October.

The focus will remain very much on the economic calendar today with the release of the second quarter GDP. Analysts are expecting the UK economy to have contracted by around -20.5% in the April – June period, the period most affected by the lockdown. This comes after a -2.2% decline in the first three months of the year and after the Bank of England upwardly revised the GDP outlook for 2020.

Investors will be looking closely at the June month on month GDP reading for clues as to how the economic recovery is progressing.

The Euro advanced in the previous session as German investor sentiment improves amid rising optimism surrounding the economic recovery. The German ZEW survey increased to 71.5 reflecting hopes that the Eurozone’s largest economy is well on the road to recovery from the coronavirus crisis. Economic sentiment had registered 59.3 last month.

Today Eurozone industrial production data will be under the microscope. Analysts are expecting industrial output to increase an impressive +10% month on month in June, after a 12.4% jump the previous month. A strong reading will add to the mounting evidence that the economic recovery in the bloc is gaining momentum.