- Rising oil prices following upbeat comments regarding demand outlook from Saudi’s Aramco is dragging on the Pakistan Rupee (PKR)

- Rupee hits all time low 168.75 before easing back slightly

- US Dollar (USD) trades broadly higher versus its peers following from Friday’s upbeat jobs report

- Trump signs executive orders to backstop unemployment benefits amid Congress impasse

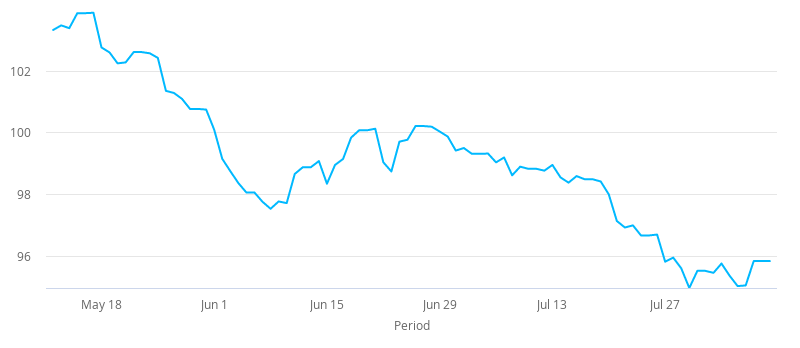

The US Dollar Pakistani Rupee (USD/PKR) exchange rate is pushing higher on Monday. The pair settled marginally lower on Friday -0.1% at 168.40. Across the week, however, the pair traded broadly flat.

At 09:15 UTC, USD/PKR trades +0.5% at 168.55, just easing back slightly after reaching the all time high of 168.75 earlier in the session.

The Rupee is under pressure as the price of oil surges making imports more expensive. West Texas Intermediate is trading 1.7% higher boosted by upbeat data from the US and China and by a bullish demand picture from Saudi Aramco, the largest oil producer in the world.

The chief executive of state-owned Aramco said that oil consumption in Asia, Aramco’s largest market has almost returned to pre-coronavirus levels. Other economies across the globe are expected to follow suit and lift demand further.

Furthermore, Iraq announced that it will cut production by a further 40,000 barrels a day to compensate overproduction over the past three months. Combined, these factors are overshadowing the rescue package deadlock in Washington.

The US Dollar trades broadly higher versus its major peers on Friday and is just about managing to hold onto those gains at the tart of the new week. The move higher came after the US labour market was shown to have added 1.7 million jobs last month, slightly ahead of expectations of 1.5 million jobs. The unemployment rate also declined to 10.2% and hours worked increased. This was some well needed good news for the US Dollar, which has been under pressure over concerns that rising covid cases are undermining the economic recovery in the US.

US Congress failed to break the rescue package impasses, leading to President Trump stepping in and signing executive orders backstopping unemployment benefits and cutting income taxes among other measures. Whilst this is a step in the right direction a broader plan will be needed to keep the US Dollar investors happy longer term.