- Indian Rupee (INR) rallies on US Dollar (USD) weakness

- Indian service sector activity contracts further in July

- US Congress fails to agree fresh fiscal stimulus package

- ADP payrolls & non-manufacturing PMI figures in focus, could show momentum slowing

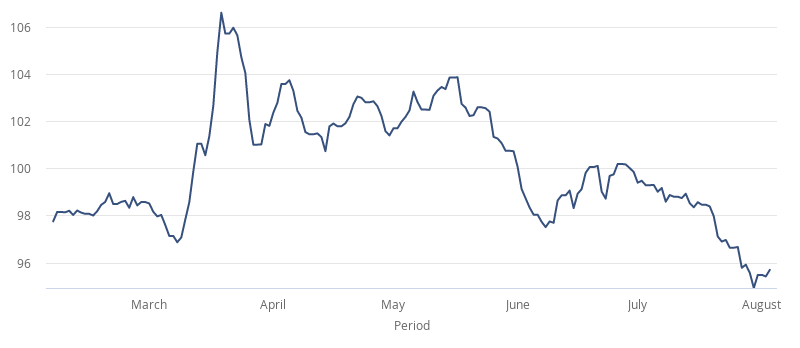

The US Dollar Indian Rupee (USD/INR) exchange rate is extending losses from the previous session. The pair settled on Tuesday -0.16% at 75.06. At 09:45 UTC, USD/INR had broken through 75.00 to trade -0.2% to 74.84.

The Rupee is taking advantage of US Dollar weakness, driving higher despite data showing that activity in the service sector remained depressed in July. According to the IHS Markit service sector purchasing mangers index stood at 34.2 July only up very slight from 33.7 in June and still deep in contraction. The level 50 separates expansion from contraction.

This was the fifth consecutive month of contraction amid the prolonged coronavirus downturn and weak demand. Whilst lockdown measures have been eased, the service sector is not showing any meaningful signs of picking up. Furthermore, the rate of job shedding was the fastest on record amid anaemic demand and temporary business closures. Looking ahead the 12-month outlook was negative for a third successive month raising fears of a substantial economic downturn.

The Reserve Bank started the bi-monthly monetary policy meeting and the six member committee will announce its monetary policy decision tomorrow.

The US Dollar has fallen sharply lower versus its major peers. Investors are growing increasingly nervous over the Democrats’ and Republican’s inability to agree to new rescue package. Without fresh fiscal stimulus the US economy’s economic recovery would falter.

Whilst both parties are saying that they will reach an agreement by the Friday summer break deadline, investors appear less sure.

Concerns over Congress’ lack of progress overshadowed strong factory data. The 6.2% jump in factory orders added to evidence that the US manufacturing sector’s recovery is gaining momentum.

Attention will now turn to ADP private payrolls data and ISM non-manufacturing figures. These re closely watched macro-economic data points because they are lead indicators for Friday’s non-farm payroll report.

Expectations are for 1.5 million private jobs to have been created in July, down slightly from the 2.3 million created last month. The service sector is also expected to show a slight easing at 55 in July, down from 57.1. Investors will be watching closely to see whether rising coronavirus cases are starting to undermine the economic recovery in the dominant service sector.