- Pakistan Rupee (PKR) hits 11 day high and trades just shy of all time high of 168.75

- Pakistan exports declined steeply in final quarter of fiscal year 2019-20, although have picked up in July.

- US Dollar (USD) trades lower versus major peers after Congress remain apart on rescue package

- ADP payroll data & non-manufacturing PMI to show a slight easing in recovery momentum

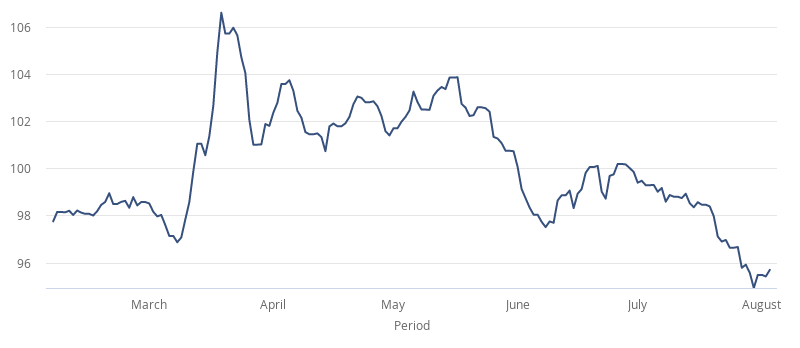

The US Dollar Pakistan Rupee (USD/PKR) exchange rate is bounding higher on Wednesday, extending gains from the previous session. The pair settled on Tuesday +0.6% higher at 168.15.

At 08:45 UTC, USD/PKR trades +0.1% at 168.25, this is off the 11 day high of 168.50 reached earlier in the session and just shy of the all time high of 168.75 hit last week.

The Rupee is under pressure as the extent of the hit to exports from the coronavirus crisis was laid bare to the Federal Cabinet. In the last quarter of the fiscal year 2019 – 20 exports declined -57% in April followed by a -34% decline in May and -6% in June due to the covid pandemic, although exports increased +5.8% year on year in July.

Whilst the cabinet was informed that economic growth was a matter of concern, it was also informed that economic indicators are moving in the right direction, with a visible improvement in remittances.

The US Dollar is trending lower versus its major peers on Wednesday as Democrats and Republicans in Congress failed once again to reach an agreement on a new fiscal support package. Both sides say that a deal is achievable before Friday when the summer break begins. However, investors are less convinced.

Investor attention will turn towards the US economic calendar. ADP private payroll figures and ISM non-manufacturing data are both due for release later in the session. Both of these macro points will be closely watched because they are viewed as lead indicators ahead of Friday’s all-important non-farm payroll report.

Economists expect 1.5 million private jobs to have been created in July. This is down from 2.3 million created in the previous month. The service sector is also expected to show a slight easing in activity at 55 in July, down from 57.1, although the sector remains firmly in expansion above the 50 level. Investors will be keen to see that the rising coronavirus cases in the sunbelt area of the US are not hampering the economic recovery in the US.