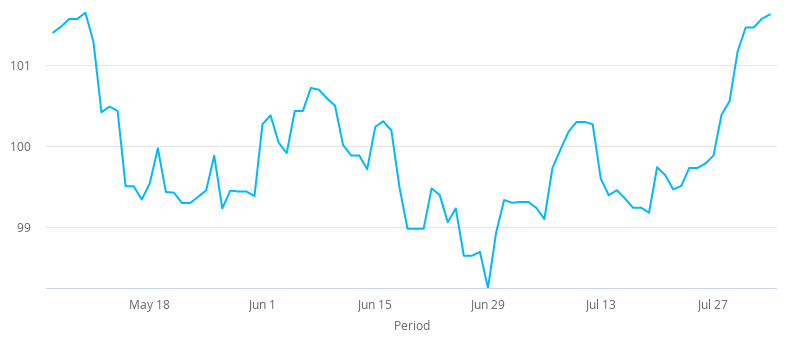

GBP/INR is declining in early trading on Wednesday. The price started to correct yesterday after a two-week rally that sent the pair higher by 4.30%. Currently, one British pound buys 98.018 Indian rupees, down 0.08% as of 6:50 AM UTC. The general stance is still bullish for the sterling, as India struggles with a rapid increase in coronavirus cases and prolonged lockdown measures in major states and cities.

Earlier today, IHS Markit released services activity data for India. The sector has declined for the fifth month in a row in July. Nevertheless, the pace of contraction has slowed compared to previous months.

India’s services purchasing managers index (PMI) fell to 34.2 in July from 33.7 in June. The 50 mark separates growth from contraction.

Lewis Cooper, an economist at IHS Markit, commented:

“The coronavirus pandemic and subsequent introduction of lockdown measures continued to weigh heavily on the Indian service sector in July. Business activity and new orders dropped again, with the rates of decline remaining rapid overall. Panellists frequently reported temporary company closures and weak demand as a result of the pandemic.”

The decline was driven by a further drop in sales. Businesses said that the performance was impacted by the COVID-19 pandemic.

Bank of England Might Cut Rates in November

In the short-term, the pound might have declined on expectations that the Bank of England (BoE) might reduce the interest rate to zero in November. Economists at Bank of America Global Research said that Britain’s central bank would slash the rate to zero and even might go further in 2021. The report reads:

“The BOE has, in our view, no monetary ammunition left if it believes the lower bound for bank rate is the current 0.1%. Downside economic risks lie ahead. With few options left we see the probability of the BOE cutting bank rate negative next year approaching 50%.”

Economists said that the BoE could consider negative rates if needed. Previously, former BoE Governor Mark Carney ruled out any possibility of negative rates, but the coronavirus crisis might leave the central bank with no other choice. BoE policymakers will meet tomorrow, but they will most likely leave the rate unchanged.