- Pound (GBP) rises ahead of service sector PMI, which is expected to confirm solid expansion

- BoE make monetary policy announcement, no change expected to interest rates

- US Dollar (USD) under heavy selling pressure as Democrats and Republicans failed to agree on rescue package

- US ADP payroll report and non manufacturing PMI both are expected to show a slight slow down

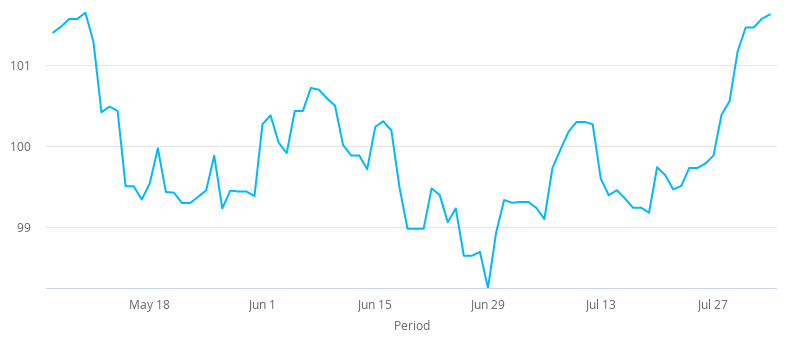

After three straight sessions of declines, the Pound US Dollar (GBP/USD) exchange rate is advancing on Wednesday. The pair settled on Tuesday -0.1% at US$1.3062 after briefly slipping through US$1.30. At 06:15 UTC, GBP/USD trades +0.25% at US$1.3093.

The Pound is pushing northwards ahead of the closely watched UK service sector Purchasing Managers Index. Analysts are expecting the PMI to confirm 56.6, whereby the level 50 separates expansion from contraction, as the sector continues to rebound from its April nadir. The service sector is the sector which was most affected by the lockdown measures.

The UK service sector is the dominant sector in the UK economy accounting for around 80% of economic activity. For this reason, a solid recovery in this sector would mean that UK economic growth is also heading for a solid recovery. Any weakness in the sector could mean that the GDP recovery is slowing.

This is the ultimate data release prior to the Bank of England monetary policy announcement on Thursday. The central bank is not expected to change monetary policy, keeping interest rates at 0.25% an historic low. However, the BoE could adopt a more dovish tone as the British government starts to withdraw support from the job retention scheme.

The US Dollar is falling steeply versus its major peers as Congress failed to agree on a stimulus programme for the US again. The gridlock on Capitol Hill overshadowed more upbeat data after US factory orders beat forecasts indicating that the economic recovery in the US could still be on track.

Today attention will remain firmly on the economic calendar with the release of US ADP private payrolls and non-ISM manufacturing data, key lead indicators ahead of Friday’s non farm payroll report.

Analysts are expecting 1.5 million private jobs to have been created in July, down slightly from 2.3 million last month. The service sector is also expected to show a slight easing at 55 in July, down from 57.1.