- Broad based US Dollar (USD) weakness is propelling the Pound (GBP) to the highest level since March 12th

- Upbeat data has supported the Pound as retail sales recover, whilst Brexit concerns remain a drag

- US Dollar lacks support amid rising US – China tensions and the popularity of the Euro continues to rise

- US Durable goods expected to show solid increase in June

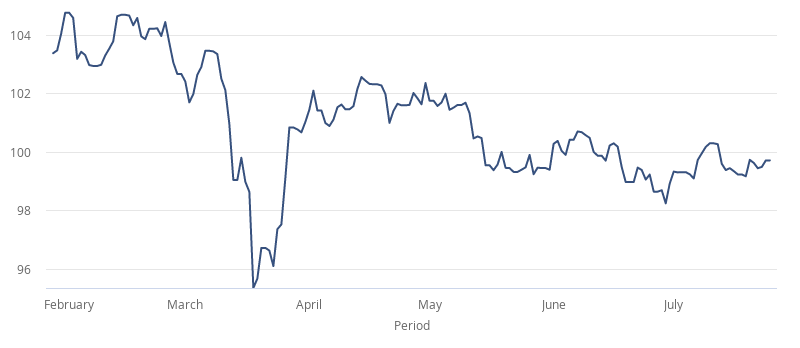

The Pound US Dollar (GBP/USD) exchange rate is extending gains from the previous week. The pair closed on Friday +1.8% at US$1.2791. At 06:00 UTC, GBP/USD trades +0.3% at US$1.2831.

Sterling has found strength from UK vaccine hopes following an encouraging update from Oxford University last week and on the back of upbeat data.

UK retail sales continued to jump higher in June, surging 13.9%, on top of May’s 12%, meaning that UK retail sales have almost returned to pre-coronavirus levels after two straight months of increases.

Brexit on the other hand, continues to act as a drag as the two Brexit negotiators, David Frost and Michel Barnier dashed hopes of a deal being achieved, following little progress in talks last week.

The US Dollar has started the week under pressure as intensifying US – Sino tensions add to concerns that the surging number of coronavirus cases the US could undermine the fragile economic recovery there.

The lack of support for the dollar amid tit for tat US – Chinese moves which has seen the closure of two consulates is in sharp contrast to the safe haven demand that the US Dollar has previously enjoyed amid rising geopolitical tensions.

US Dollar weakness comes as the popularity of the Euro soars following the EU recovery fund stimulus programme and as Europe appears to have a better grip on the coronavirus outbreak, even as Spain and Germany could be hit with a second wave. US Congress fail to agree on another round of fiscal stimulus, so far and as the recovery in the US labour market stalls.

Attention will now turn to US durable goods orders for clues as the progress of the US economic recovery. Durable goods are expected to increase a solid 6.5% in June, a still solid reading following May’s 15.7% surge. A strong reading could help boost demand for the weak US Dollar.