- Indian industrial production declines -16.6% yoy in June after -34% in May

- Oil rises 1.5% on falling inventories adding pressure to the Rupee

- US Dollar (USD) gives up some gains as additional stimulus starts to look doubtful

- US inflation expected to stabilise at 0.2% mom in July

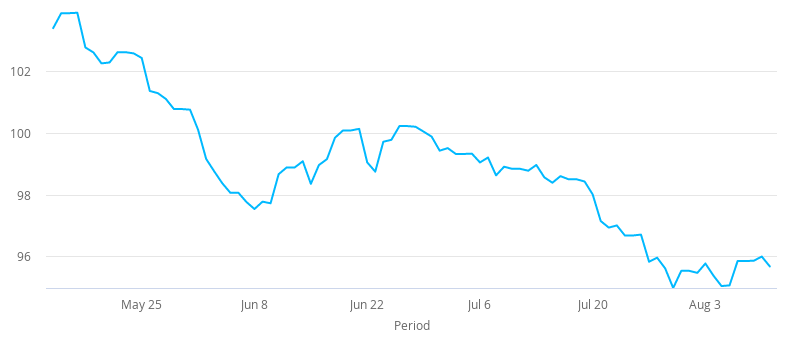

After two consecutive days of declines, the US Dollar Indian Rupee (USD/INR) exchange rate is moving higher. The pair lost -0.5% over the past two sessions settling in Tuesday at 74.61. At 10:15 UTC, USD/INR trades +0.2% at 74.82.

Indian industrial production fell for the fourth straight month in June. According to the Ministry of Statistics and Programme Implementation output plunged -16.6% year on year in June, a slight improvement on May’s 34% contraction. This was also slightly better than analysts’ forecasts of -20% contraction.

Industrial output has fallen -35.9% across the April – June period owing to the coronavirus pandemic. This is the weakest level on record. The outlook for the sector remains highly uncertain and weak as a series of localised lockdowns imposed by various federal governments hinder the normalisation of economic activity. Economists are not expecting a strong increase in output in July and August.

Rising oil prices are also adding pressure to the Rupee. West Texas Intermediate is trading 1.5% higher after US oil inventories fell by more than expected. An industry report revealed that US inventories fell by 4 million barrels last week, significantly more than the 2.9 million expected. This was the third sizeable fall in a row, boosting hopes that demand in the US can weather the coronavirus pandemic.

The US Dollar started the session firmly higher versus its major peers. However, the greenback was paring gains amid growing concerns over Congress agreeing additional stimulus for the US economy to help support the economy through the covid crisis.

US inflation data is now moving into focus. Analysts expect inflation, as measured by the consumer price index to rise 0.2% in July compared to a month earlier. This would show inflation to be stabilising after rising 0.2% month on month in June. A solid reading will help to calm fears that the resurgence of coronavirus cases is undermining the economic recovery.