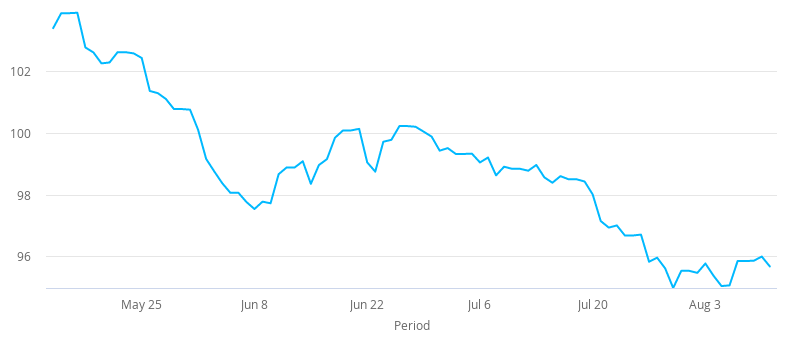

- Dollar uptick helped by higher yield.

- US inflation due later in the day

- Record bond selling listed

Investors are demanding more yield from the US bond and have pushed its price lower ahead of the scheduled record issue of the bonds by Uncle Sam. The rise in yields has also made the dollar attractive, encouraging more bids on the greenback.

The cut in capital gains tax suggested by the US President would require further funding and could be a drain on the finances.

The inflation figures to be released later in the day are expected to show steady gains and might help the dollar as well as the yields.

The unemployment benefits, under the recent executive orders, now stands at 300 dollars-a-week, half of the benefit under the expired program. The individual states were required to put 100 dollars-a-week as special unemployment benefits, and it attracted criticism from various quarters, prompting Washington to roll back that stipulation.

Trump issued the executive orders after the Republican and Democrats failed to reach an agreement over the proposed bill to be presented in the Congress. There are also concerns regarding the legal standing and timeline of executing the order.

The haven-linked dollar has benefited from this uncertainty.

The economy might suffer if the consumption gets hit as unemployed are left without much to spend.

China has reiterated its claim over Taiwan as its indispensable part and also send a fighter jet closer to the region, earlier this week. This development will add to the current tensions between China and the US after the recent altercations regarding Hong Kong.

The coronavirus worries continue unabated as the US recorded the highest number of deaths since May. But the broader trend suggests a decline in infections and mortalities. Texas decided to keep the restrictions, ignoring its better situation.

Russia’s announcement of the first-ever coronavirus vaccine failed to trigger much enthusiasm as questions remain over the vital Phase-3 trial – skipped by the country.

Massachusets-based Moderna received a preorder of 100 million doses from the US administration, and any positive developments can turn the tide against the dollar.

Europe’s COVID-19 situation is better than the US, as of now but there are worries over rising infection numbers, especially in Germany and new regions in Spain.

Broadly, the factors are in support of the dollar against the euro.