- DXY range-bound as the pandemic, economic recovery and politics in focus.

- Dallas Fed index, Fed speak eyed.

The dollar index was trading around 94.50 region today, unable to make a directional move.

The index, weighing the dollar value against a basket of currencies, has been on an uptrend in recent weeks. DXY is now trying to move above its six-month resistance line in the 94.50/60 band.

The chances of a breakout remain low as the global markets are trading in a range-bound manner and are near Friday’s closing levels.

The traders will focus on the monthly US labour due on Friday. The Dallas Fed manufacturing index and Cleveland Fed Loretta Mester speech would be the immediate triggers for the dollar. Market participants will also follow the presidential debate between Trump and Biden on Tuesday.

The 94.50/60 levels will be critical for further bullishness in the US dollar, while the bulls are keeping the bias intact as of now in today’s trading. But, a broader view indicates a neutral to bearish sentiments in the greenback and the bullishness might be temporary. The lower for longer policy approach by the US Fed is a major headwind for the dollar. It will also be affected by the hopes of global economic recovery, bearish trader positions, fiscal/monetary stimulus and the upcoming elections in November.

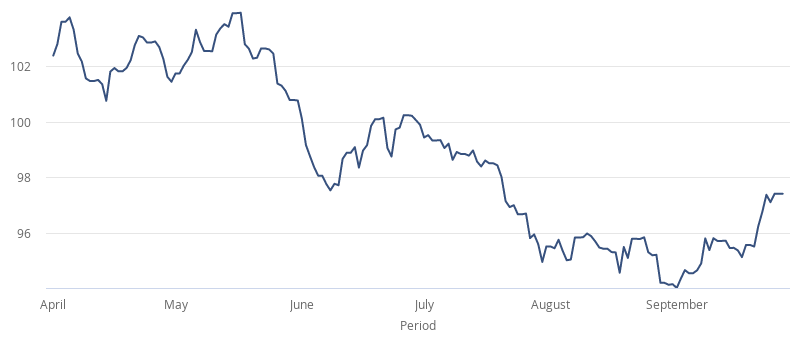

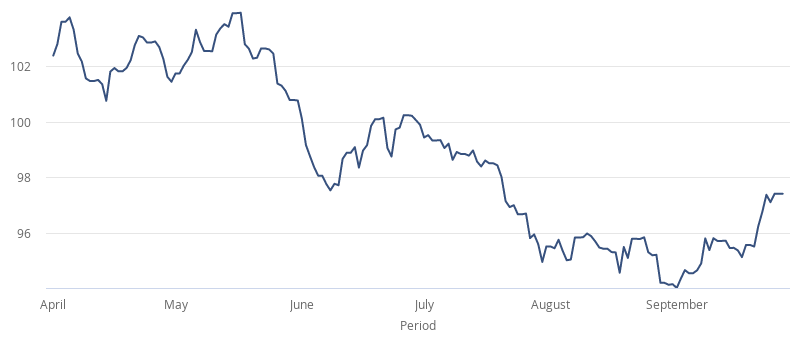

USD Index Today - last 180 days

Currency Index charts show the

strength of a single currency based on a basket of foreign currencies. This is done using a weighted mean (an average) of the 5 largest routes from that source currency and their daily FX rates. You can explore

live exchange rates here.

Currencylive.com is a news site only and not a currency trading platform. Currencylive.com is a site operated by Wise US Inc ("We", "Us"), a Delaware Corporation. We do not guarantee that the website will operate in an uninterrupted or error-free manner or is free of viruses or other harmful components. The content on our site is provided for general information only and is not intended as an exhaustive treatment of its subject. We expressly disclaim any contractual or fiduciary relationship with you on the basis of the content of our site, any you may not rely thereon for any purpose. You should consult with qualified professionals or specialists before taking, or refraining from, any action on the basis of the content on our site. Although we make reasonable efforts to update the information on our site, we make no representations, warranties or guarantees, whether express or implied, that the content on our site is accurate, complete or up to date, and DISCLAIM ANY IMPLIED WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE. Some of the content posted on this site has been commissioned by Us, but is the work of independent contractors. These contractors are not employees, workers, agents or partners of Wise and they do not hold themselves out as one. The information and content posted by these independent contractors have not been verified or approved by Us. The views expressed by these independent contractors on currencylive.com do not represent our views.