- Pound (GBP) trades high as hopes grow for a Brexit trade deal

- As the deadline of 15th October approaches Brexit headlines will be in focus

- Australian Dollar (AUD) trades higher versus peers on upbeat market mood & China data

- Chinese factory profits rise for 4th straight month

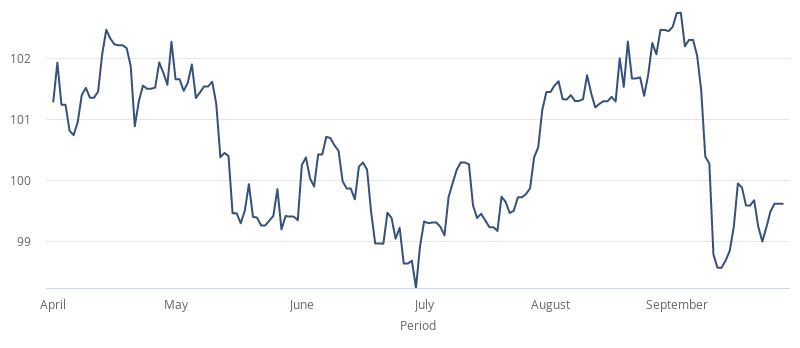

The Pound Australian Dollar (GBP/AUD) exchange rate is trending northwards on Monday, adding to gains from the previous week. The pair closed on Friday +2.3% at 1.8132, slightly off the week’s high of 1.8184. At 08:15 UTC, GBP/AUD trades +0.3% at 1.8191.

The Pound is charging higher across the board at the start of the new week. It is the top performing major currency as investors grow more optimistic surrounding Brexit ahead of further trade talks this week. The mood music surrounding the talks has improved after headlines over the weekend point to a higher possibility of a trade deal being achieved.

The British negotiating team is reported to have said that there will be a deal. The Confederation of British Industries head, Carolyn Fairbairn has also indicated that a deal can be reached.

Time is ticking towards the British government’s self-imposed deadline of 15th October and it would appear that the time pressure is injecting a sense of urgency into talks which have been deadlocked for months.

Gains in the Pound could be limited s the number of coronavirus cases in the UK jumps 46% in a week. Tighter lockdown restrictions are expected in the coming days and weeks which will also certainly hamper the fragile economic recovery.

The Australian Dollar is trading lower versus the Pound but is trading higher versus the other major pairs. The risk sensitive Aussie Dollar is rising on the back of an improved mood in the market and upbeat Chinese data.

Chinese factory profits continue to see steady growth, rising for the 4th straight month in August. Industrial firms’ profits grew 19.1% YoY in August. The data shows that whilst concerns are growing over a slowing economic recovery in Europe and the US, the economic recovery in China, the world’s second largest economy has been gathering momentum. The Australian Dollar is also referred to as a China proxy.