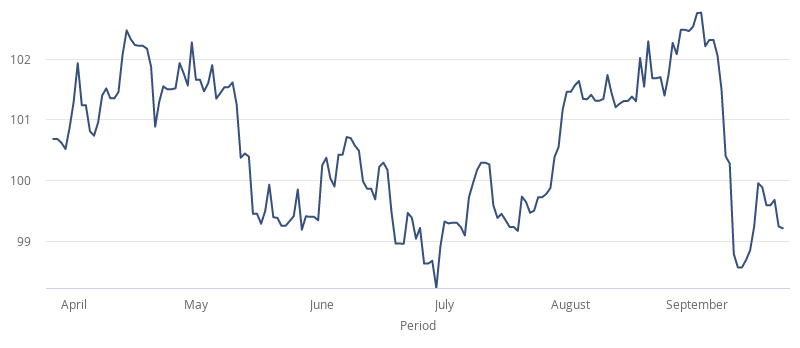

- GBP/USD below the 200-day moving average.

- Pandemic concerns weigh on the sterling.

- US dollar strength drags the pair.

GBP/USD witnessed a tug-of-war between the bulls and the bears on Tuesday. The pair first caught selling to 1.2700 levels and then climbed up around 150 pips on the back of BoE Governor Andrew Bailey downplaying negative interest-rate expectations. He made the comments during an online discussion hosted by the British Chambers of Commerce while saying that the debate regarding rate below zero doesn’t imply a possibility of using it. The official further added that the use of negative interest across the world worked with mixed results and its effectiveness depends on the timing and a country’s banking structure.

The positive headlines also helped the sterling that the Brexit talks are progressing better than expected, and a deal can’t be ruled out at this stage. The EU Chief Brexit Negotiator Michel Barnier will be visiting London for informal talks, a piece of news confirmed by the UK PM spokesman. The spokesman added that the UK is working hard for a deal. But, the optimism was doused by Ireland’s foreign minister, Simon Coveney comments that there is a growing feeling that Britain might not want a settlement and UK government tactics are proving detrimental to the progress of the negotiations.

UK PM announced many pandemic related restrictions after a fresh spike in the cases recently and indicated further moves if situations don’t improve. The GBP/USD weakened on the news and the renewed strength in the dollar. The pair closed near the low end of the trading range and opened weak today during the Asian trading.

Chicago Fed President Charles Evans’ hawkish tone regarding the quantitative easing and possible interest rate hikes added to the dollar strength. The greenback has built momentum recently as the second wave of coronavirus emerged world over. The GBP/USD fell below 200-day SMA, in the process hitting a two-month low during the Asian session today.

As the UK economic docket is scarce, the Brexit-related headlines will drive action in the pair before the flash version of the US PMI prints for September during the US session. The Fed Chair’s congressional testimony continues for the second day today and will be tracked by the USD traders for clues regarding monetary policy and economic strength.