- Pound (GBP) advances after retail sales +0.8% vs 0.7% forecast

- Gains could be capped after BoE moved closer towards negative rates

- Australian Dollar (AUD) amid risk off trading

- Could remain sentiment driven amid quiet economic calendar

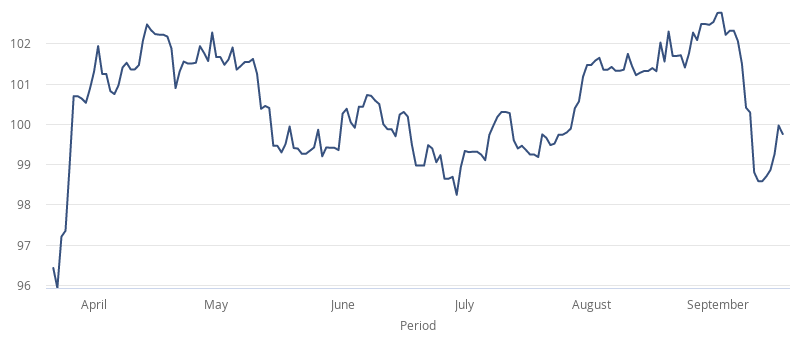

The Pound Australian Dollar (GBP/AUD) exchange rate is trading flat on the final trading day of the week. The pair settled -0.05% on Thursday at 1.7734. At 08:15 UTC, GBP/AUD is trading +0.1% at 1.7750. The pair is on track to gain over 1% across the week after tanking over 3.7% lower across the previous week.

According to the Office of National Statistics, UK retail sales are on the rise for the 4th straight month, growing +0.8% MoM in August. This was down from July’s 3.6% jump but still ahead of the 0.7% expected. Higher spending on DIY and household goods overshadow lacklustre spending on clothing. The data shows that the retail industry is progressing along a road of fragile recovery.

The data comes after the Bank of England took another step towards negative interest rates. In its monetary policy announcement yesterday, the BoE kept interest rates on hold at 0.1%, as expected. The central bank also warned over the outlook for growth as the UK economy faces serious challenges such as rising unemployment and Brexit. The BoE hinted that interest rates could fall below zero next year.

The Australian Dollar is softer on Friday as the broader risk tone in the market is also slightly negative. Concerns are growing, particularly in Europe over the recent spike in covid cases. The World Health Organisation warned that the situation in Europe was concerning.

The Dollar had managed to eke out small gains in the previous session after data revealed that unemployment unexpectedly fell in August to 6.8%, down from 7.5%. The figures indicate that the Australian labour market is holding up better than forecast.

There is no high impacting Australian data due until next Wednesday, when investors will look to retail sales figures for further clues over the health of the recovery.