- Pound (GBP) after retail sales rise +0.8% MoM in August

- BoE hinted towards negative interest rates

- US Dollar weakens amid concerns for economic outlook

- US consumer confidence expected to tick higher in September

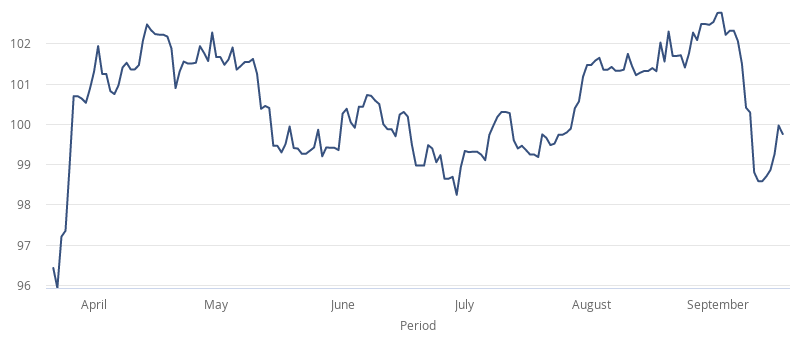

The Pound US Dollar (GBP/USD) exchange rate is trading mildly lower after 4 straight days of gains. The pair settled +0.05% on Thursday at US$1.2972. At 06:15 UTC, GBP/USD trades flat at US$1.2970, after failing to break through $1.30 in the Asian session. The pair is on track to gain 1.3% across the week after dropping -3.7% in the previous week.

UK retail sales are on the rise for the 4th straight month, growing +0.8% MoM in August, down from July’s 3.6% surge but still ahead of analyst forecasts of 0.7%. Higher spending on DIY and household goods overshadowed lacklustre spending on clothing, which highlights the struggles that UK high street retailers are facing.

The data comes after the Bank of England moves closer to negative interest rates. In its monetary policy announcement, the central bank kept interest rates unchanged, as expected. They also warned on the outlook for growth given the headwinds facing the UK economy, such as rising unemployment and Brexit. The BoE had been sitting on the fence regarding negative interest rates. However, it has hinted that interest rates could fall below zero next year.

The US Dollar sold off late in the US session and across the Asian session, paring gains early in the day. Weak US data cast doubts over the strength of the US economic recovery and its outlook.

US initial jobless claims remained elevated at 860,000, above the 850,000 forecast. Both housing starts and the Philadelphia Fed business index fell. The downbeat data came after the US Federal Reserve, earlier in the week said that is expected the US economy to contract by less than initially feared -3.7% versus -6.5%.

The US economic calendar is relatively quiet, with Michigan consumer confidence headlining the docket. Expectations are for a slight uptick in consumer confidence to 75 for September, up from 74.1.