- Update from Federal Cabinet meeting suggested that the economic picture in Pakistan is improving

- US crude oil jumps 1.5% on falling US inventories, weighing on the Rupee

- US Dollar easing off highs as doubts rise over whether additional US stimulus will be agreed

- US consumer inflation expected to hold steady at +0.2% increase mom

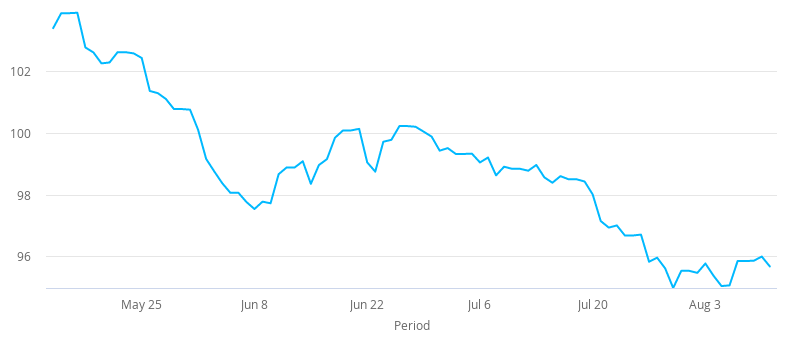

After inching lower in the previous session, the US Dollar Pakistani Rupee (USD/PKR) exchange rate is on the rise again today. The pair settled on Tuesday -0.06% at 167.90. At 09:15 UTC, USD/PKR trades +0.3% at 168.55 as the pair continues to hover around its all-time high.

The Pakistani Rupee is under pressure owing to US Dollar strength. The Rupee slipped lower even as headlines from the Federal cabinet’s meeting were upbeat. The fiscal deficit, which was expected to be 9.1%, was 8.1%. The current account deficit which was $20 billion when the ruling party Pakistan-Tehreek-e-Insaf came into power was $13 billion last year and was just $3 billion in 2019-20. Furthermore, Dollar reserves had increased to $12.5 billion, up from $8.5 billion.

Elsewhere, rising oil process are dragging on the Rupee. West Texas Intermediate jumped 1.5% on Wednesday after US crude oil inventories fell by more than expected.

The US Dollar kicked off the session on the front foot versus its major peers. However, as the European session has progressed the US Dollar has steadily lost ground.

The impasse in Washington continues and concerns are growing that US lawmakers may not agree to additional stimulus to support the US economy through the coronavirus crisis. Negotiators have walked away from talks without a deal and most law makers have now returned to their home states for the summer recess. Whilst recent data has shown that the US economy is on the road to recovery from the pandemic, fears are growing that without additional support that recovery could be undermined.

Investors’ attention will now turn towards US inflation, as measured by the consumer price index (CPI). CPI data is expected to reveal that inflation stabilised in July, increasing +0.2% compared to the previous month. This would be in line with June’s reading. US inflation had collapsed in March and April, before recovering in May and June. An upbeat print could help boost the US Dollar.