- WTI crude prices outweighed by the dollar strength

- USD/CAD gains 0.28 Percent

- US CPI expected today

USD/CAD was trading strong ahead of the European session, holding onto the gains made in the Asian market opening. The lack of domestic catalysts means the pair will be relying on dollar strength and crude-oil dynamics.

The US dollar strength overshadowed the recent gains in the WTI crude prices – Canada’s top export item.

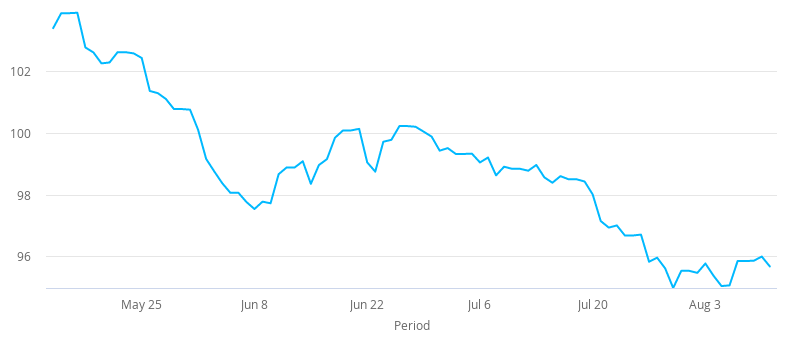

The dollar recovered from a two-year-plus low recently, as the world awaits stimulus as well as vaccine news. The dollar index, reflecting trading against a basket of currencies, is on a four-day winning streak, trading at 93.85 up 0.21 Percent.

Even though, the American Congress hasn’t discussed the COVID-19 relief package; markets are hoping a trillion-plus dollar deal will come into fruition sooner than later. President Trump’s recent executive orders for unemployment benefits can be considered as a sure sign that he will go to any length to make the deal a possibility. Trump has also cited an agreement with Moderna as a sign of his intentions to overcome the pandemic.

WTI oil prices didn’t budge even after the weekly inventory eased the previous declines in stock, showing -4.4M draw for the week ending on August 07. The price strength might be because the US-China trade-talks hope got a fillip yesterday on upbeat comments from the People’s Bank of China’s (PBOC) Governor Yi Gang, China’s Vice Foreign Minister.

New Zealand’s central bank’s QE didn’t upset the market sentiment ahead of the July US Consumer Price Index expected later in the day. Inflation is projected at 0.8 Percent, an increase from 0.6 Percent; CPI ex Food & Energy (YoY) is seen at 1.1 Percent down from 1.2 Percent.

Sino-US relations, virus updates, and stimulus package are the other drivers, apart from the inflation data, that traders will be watching for further direction.