- EUR/USD call options data shows bullishness

- Strongest bullishness in five months

- Geopolitical risks can stall the up-move

EUR/USD has been on a strong rally from its March low of 1.0636; it has recently touched a 26-month high of 1.1909 and is last seen trading at 1.1873.

The pair’s option market data reveals a continued bullish outlook among investors and traders. The difference in volatility premium between call and put options – especially out-of-the-money strikes, is now at a five-month high. The measure known as risk reversals was at 0.675 yesterday, higher than 0.50 the previous day, according to Reuters’ data. The Wednesday data is the highest since March and indicates the most robust bullish bias for Euro, against the dollar, in the last five months.

The call options give their holders a right to buy an asset at a predetermined price – often called strike price; put options are the right to sell at the specified strike price.

Right now, the EUR/USD pair is enjoying a positive risk reversal: Multi-month high level indicates investors are betting on further upside action.

However, developments in the political front are not very supportive of the pair. The US-China tensions are still on the boil with the Trump administration saying on Wednesday that TikTok and WeChat messenger are security threats; indicating more efforts to cut down the presence of untrusted Chinese apps in the US digital network.

The haven-linked US dollars might stage a comeback if political developments linked to China and lack of progress for the stimulus bill in the US Congress starts worrying investors.

Today, markets will be looking forward to the German Factory Orders for June and weekly US jobless claims.

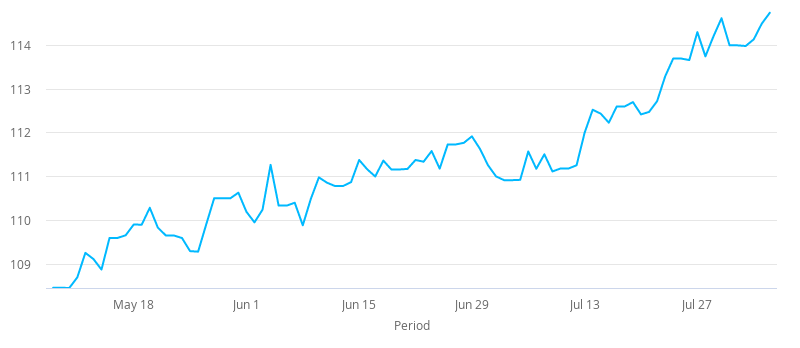

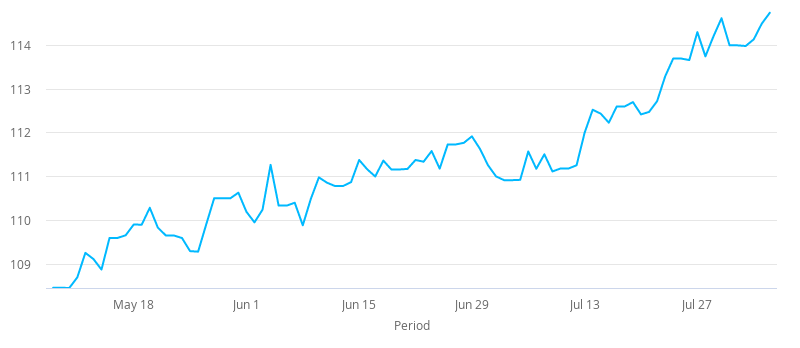

EUR Index Today - last 90 days

Currency Index charts show the

strength of a single currency based on a basket of foreign currencies. This is done using a weighted mean (an average) of the 5 largest routes from that source currency and their daily FX rates. You can explore

live exchange rates here.

Currencylive.com is a news site only and not a currency trading platform. Currencylive.com is a site operated by Wise US Inc ("We", "Us"), a Delaware Corporation. We do not guarantee that the website will operate in an uninterrupted or error-free manner or is free of viruses or other harmful components. The content on our site is provided for general information only and is not intended as an exhaustive treatment of its subject. We expressly disclaim any contractual or fiduciary relationship with you on the basis of the content of our site, any you may not rely thereon for any purpose. You should consult with qualified professionals or specialists before taking, or refraining from, any action on the basis of the content on our site. Although we make reasonable efforts to update the information on our site, we make no representations, warranties or guarantees, whether express or implied, that the content on our site is accurate, complete or up to date, and DISCLAIM ANY IMPLIED WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE. Some of the content posted on this site has been commissioned by Us, but is the work of independent contractors. These contractors are not employees, workers, agents or partners of Wise and they do not hold themselves out as one. The information and content posted by these independent contractors have not been verified or approved by Us. The views expressed by these independent contractors on currencylive.com do not represent our views.