- USD bearishness pushed the pair down

- JPY also not in favour during upbeat market mood

- Traders look ahead to US ADP report and ISM Non-Manufacturing PMI

The USD/JPY bounced-up 20 pips from its weekly lows and was trading near the day’s high – around the 105.7 mark.

The pair had earlier extended its bearish moves from the 106.45 levels and continued depressed in the first half of the trading action. The better-than-expected US ISM Manufacturing PMI on Monday couldn’t dilute the scepticism regarding the US economy’s recovery, putting the greenback’s strength to the test.

Adding to the trouble for the US economy is the lack of clarity on the US fiscal-stimulus-deal progress. The lawmakers are reportedly far-off from reaching a consensus, even though both Republican and Democratic camps have indicated to work towards having a deal by the end of this week.

Also, it has to be noted that the US Treasury Secretary Steven Mnuchin downplayed the chances of the stimulus to be anywhere near the 3.4 trillion dollars sought by the democrats. Such differences of expectations in both camps exerted pressure on the USD/JPY, balanced by the subdued demand for the Japanese Yen; due to the upbeat mood in pro-risk assets like equities and commodities.

Traders and investors are looking forward to the ADP report on private-sector employment and ISM Non-Manufacturing PMI for July for further action on the pair.

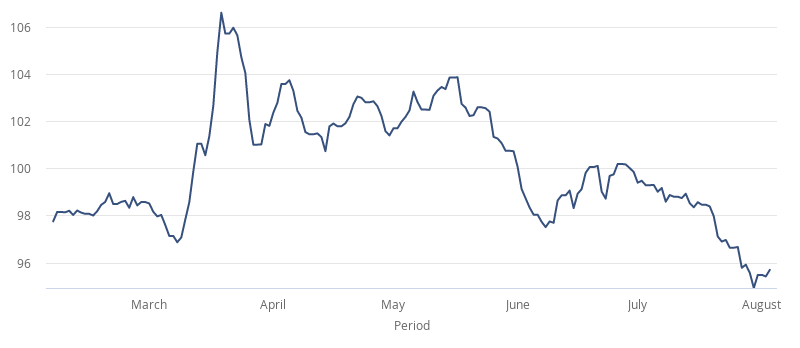

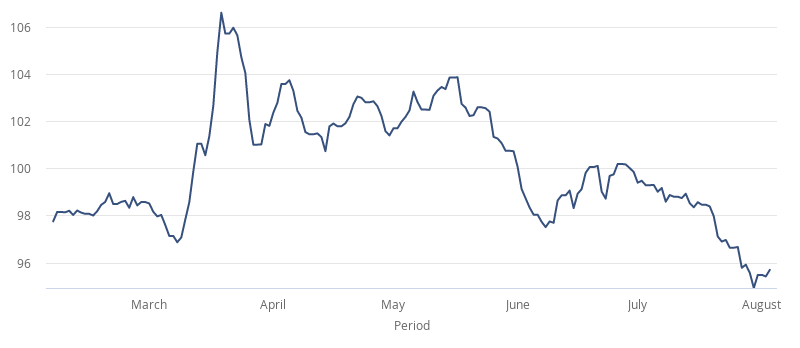

USD Index Today - last 180 days

Currency Index charts show the

strength of a single currency based on a basket of foreign currencies. This is done using a weighted mean (an average) of the 5 largest routes from that source currency and their daily FX rates. You can explore

live exchange rates here.

Currencylive.com is a news site only and not a currency trading platform. Currencylive.com is a site operated by Wise US Inc ("We", "Us"), a Delaware Corporation. We do not guarantee that the website will operate in an uninterrupted or error-free manner or is free of viruses or other harmful components. The content on our site is provided for general information only and is not intended as an exhaustive treatment of its subject. We expressly disclaim any contractual or fiduciary relationship with you on the basis of the content of our site, any you may not rely thereon for any purpose. You should consult with qualified professionals or specialists before taking, or refraining from, any action on the basis of the content on our site. Although we make reasonable efforts to update the information on our site, we make no representations, warranties or guarantees, whether express or implied, that the content on our site is accurate, complete or up to date, and DISCLAIM ANY IMPLIED WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE. Some of the content posted on this site has been commissioned by Us, but is the work of independent contractors. These contractors are not employees, workers, agents or partners of Wise and they do not hold themselves out as one. The information and content posted by these independent contractors have not been verified or approved by Us. The views expressed by these independent contractors on currencylive.com do not represent our views.