- Rising commodity prices, such as gold and iron ore are supporting the commodity linked Australian Dollar (AUD)

- Rising covid cases in Victoria and Australia’s AAA rating on negative watch by S&P rating agency caps gains

- Pound (GBP) trades broadly higher versus majors ahead of service sector PMI

- Data could start to falter as government starts to withdraw support from furlough scheme

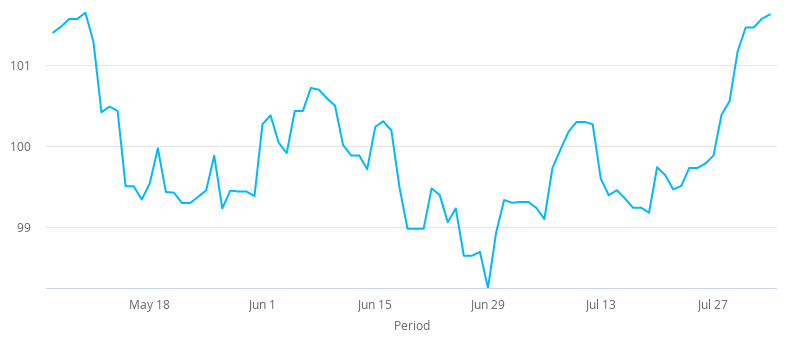

The Pound Australian Dollar (GBP/AUD) exchange rate is extending losses for a second consecutive session on Wednesday. The pair settled -0.55% lower on Tuesday at 1.8253. At 08:00 UTC, GBP/AUD trades -0.15% at 1.8220.

The Australian Dollar, a commodity currency, is finding support from higher iron prices and surging gold prices. A pledge by the Reserve Bank of Australia to buy $500 million in bond purchases to support the economy has also added to the upbeat tone.

The price of gold has soared to an all time high of US$2030.85 per ounce. Australia is the third biggest gold producer globally therefore the sky-high gold price is supportive of the Australian economy and Aussie Dollar. Iron ore, Australia’s largest export is also on the rise boosting the currency.

Meanwhile coronavirus concerns in Victoria are capping gains. The number of coronavirus cases in the state of Victoria increased by a daily record of 725 cases, raising concerns that the lockdown in Melbourne could be widened or tightened.

The international rating agency S&P Global have also put Australia’s AAA credit rating on negative watch, which could boost the case of Aussie Dollar bears.

The Pound is trading broadly higher versus its major peers as data continues to show the economic recovery in the UK remains on track.

Car sales increased 11% in July compared to last year in the first full month that car showrooms and dealerships were open since lockdown measures eased. This was also the first rise in car sales since December last year showing the demand was picking up. However, year to date demand remains down 40% on the year.

Attention will now turn to UK service sector purchasing mangers index data. Analysts are expecting the figures to confirm solid expansion with 56.6 on the index. The level 50 separates expansion from contraction.

Whilst data so far is showing the UK economic recovery to be on track this could change soon as the government starts to withdraw support from the job retention scheme.