- Reserve Bank of New Zealand surprises with QE increase, policy rate unchanged.

- Dollar index in red after a positive start

- NZD/USD witnessed a sharp fall in the Asian session.

The NZD/USD wilted under heavy selling pressure during the Asian trading hours and touched its lowest level in more than three weeks. The pair then recovered from the low of 0.6528 dollars but is still down 0.33 Percent to trade at 0.6555 dollars. The US dollar weakness helped in the Kiwi bounce-back.

New Zealand Central Bank Expands QE

The Reserve Bank of New Zealand surprised the markets by increasing the size of its quantitative easing program to 100 billion NZ dollars. The central bank left its policy rate unchanged at 0.25 Percent in line with market expectations. The additional money instruments related to the QE package will remain in “active preparation,’ according to its release.

The US dollar index lost its momentum after touching 93.9 – a nine-day high. It was trading near 93.55, slightly down for the day. The weakness in the greenback allowed NZD/USD to cut further losses after the central bank announcement.

The US Consumer Price Index will be next in line to drive the market action for the day.

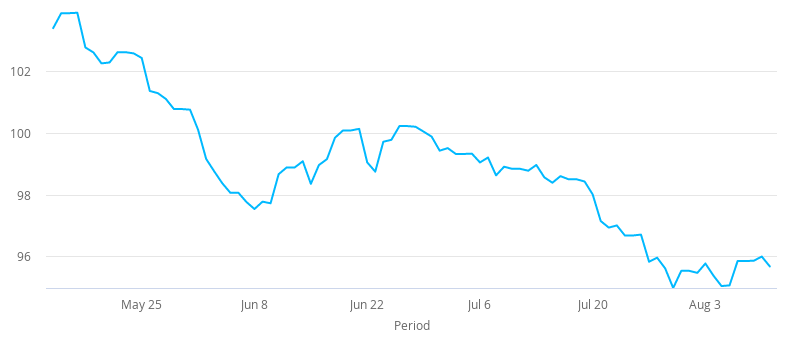

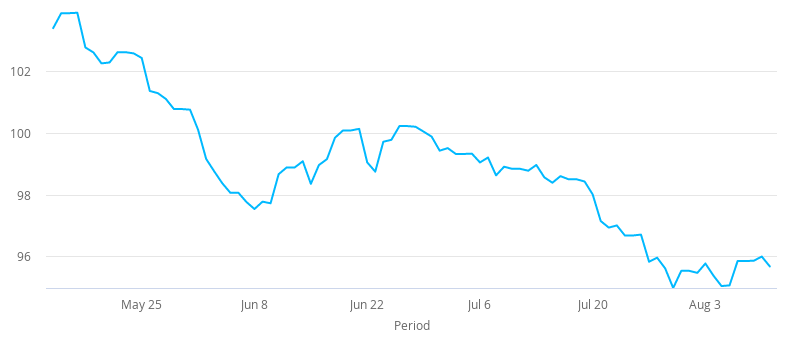

USD Index Today - last 90 days

Currency Index charts show the

strength of a single currency based on a basket of foreign currencies. This is done using a weighted mean (an average) of the 5 largest routes from that source currency and their daily FX rates. You can explore

live exchange rates here.

Currencylive.com is a news site only and not a currency trading platform. Currencylive.com is a site operated by Wise US Inc ("We", "Us"), a Delaware Corporation. We do not guarantee that the website will operate in an uninterrupted or error-free manner or is free of viruses or other harmful components. The content on our site is provided for general information only and is not intended as an exhaustive treatment of its subject. We expressly disclaim any contractual or fiduciary relationship with you on the basis of the content of our site, any you may not rely thereon for any purpose. You should consult with qualified professionals or specialists before taking, or refraining from, any action on the basis of the content on our site. Although we make reasonable efforts to update the information on our site, we make no representations, warranties or guarantees, whether express or implied, that the content on our site is accurate, complete or up to date, and DISCLAIM ANY IMPLIED WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE. Some of the content posted on this site has been commissioned by Us, but is the work of independent contractors. These contractors are not employees, workers, agents or partners of Wise and they do not hold themselves out as one. The information and content posted by these independent contractors have not been verified or approved by Us. The views expressed by these independent contractors on currencylive.com do not represent our views.