- EUR/GBP snaps a two-day winning run earlier in the day but recovers later.

- The pair pulls back from 0.9154 resistance level.

- MACD indicator stays bullish, not helping sellers much.

- 21-day EMA acts as resistance.

Bears in EUR/GBP couldn’t sustain the morning edge, and the pair was trading around 0.9160 ahead of the European trading today. EUR/GBP fell from 21-day simple moving average during the early Asian session.

The falling trendline from September 11 might question bullish strength. And, another resistance of note is the June month’s high near 0.9175 and above which 0.9200 will test buyers.

A daily close above 0.9210 – an area near the low of September 10, can help bulls to attack the monthly high of 0.9291 in EUR/GBP.

Support area around 0.9140 – marketing multiple highs in late-July ahead of the 21-day SMA near 0.9090 helps the bulls against the bears.

August high of 0.9070, along with 50-60 Percent Fibonacci retracement of April-September upside, near 0.8980-0.8910 are hindrances for the bears.

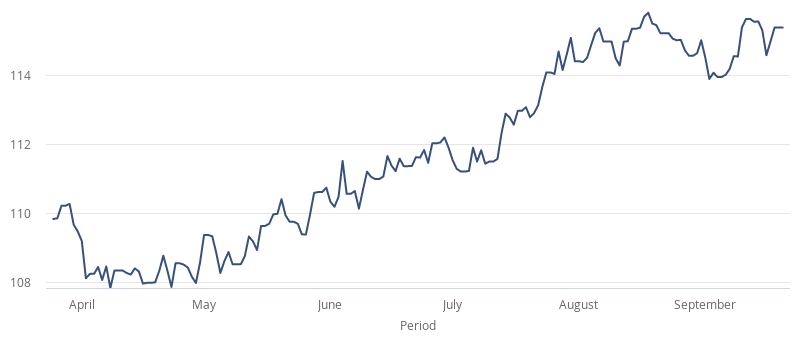

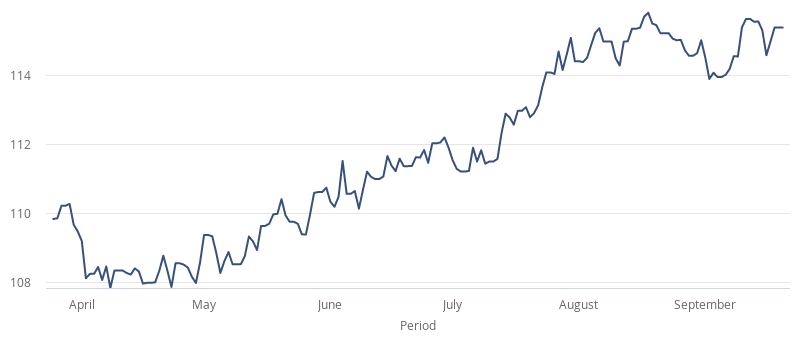

EUR Index Today - last 180 days

Currency Index charts show the

strength of a single currency based on a basket of foreign currencies. This is done using a weighted mean (an average) of the 5 largest routes from that source currency and their daily FX rates. You can explore

live exchange rates here.

Currencylive.com is a news site only and not a currency trading platform. Currencylive.com is a site operated by Wise US Inc ("We", "Us"), a Delaware Corporation. We do not guarantee that the website will operate in an uninterrupted or error-free manner or is free of viruses or other harmful components. The content on our site is provided for general information only and is not intended as an exhaustive treatment of its subject. We expressly disclaim any contractual or fiduciary relationship with you on the basis of the content of our site, any you may not rely thereon for any purpose. You should consult with qualified professionals or specialists before taking, or refraining from, any action on the basis of the content on our site. Although we make reasonable efforts to update the information on our site, we make no representations, warranties or guarantees, whether express or implied, that the content on our site is accurate, complete or up to date, and DISCLAIM ANY IMPLIED WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE. Some of the content posted on this site has been commissioned by Us, but is the work of independent contractors. These contractors are not employees, workers, agents or partners of Wise and they do not hold themselves out as one. The information and content posted by these independent contractors have not been verified or approved by Us. The views expressed by these independent contractors on currencylive.com do not represent our views.