- 1.3000 holds as a critical level for GBP/USD.

- The pair was sold aggressively on Thursday after BOE surprised with negative-rate talks.

- GBP/USD managed to bounce back, helped by Brexit deal hopes and US dollar weakness.

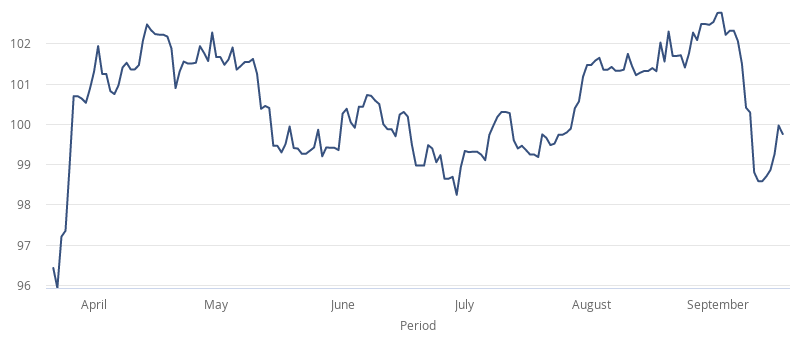

The GBP/USD saw some wild swings yesterday, driven by different fundamental triggers. It was sold heavily first after the Bank of England revealed its discussion with policymakers regarding the implementation of negative interest rates. The central bank didn’t change its benchmark interest rates of 0.10 Percent and 745 billion pounds Asset Purchase Program. Still, it highlighted the risk of high-unemployment for a more extended period and the uncertainty in the growth outlook.

The central bank updates pulled the GBP/USD to two-day lows around the 1.2865 area.

The selloff was soon met with strong buying, and the pair moved back to 1.3000 marks as the European Commission President Ursula von der Leyen said a trade deal between UK and EU is not ruled out and expressed hope that a fruitful result will come soon. GBP/USD rebounded 130 pips on the comments and was also helped by the weakness in the US dollar selling. The North American economy posted muted economic numbers: the Philly Fed Manufacturing Index fell to 15 in September from 17.2 earlier while the Initial Jobless Claims, Building Permits and Housing Starts disappointed the markets.

GBP/USD closed near the high-end of the daily range but remained below 1.3000 in the Asian session today. UK Monthly Retail Sales beat the expectations of 0.7 Percent MoM with a growth of 0.8 Percent in August.

The core retail sales that exclude auto motor fuel sales were up by 0.6 Percent MoM compared to an expectation of 0.4 Percent and 2.00 Percent growth previous.

GBP/USD price dynamics will be determined by Brexit news today and later will wait for the release of the Michigan Consumer Sentiment Index for September in the US session.

GBP/USD Short-Term Technicals

Bulls are better-off to wait for sustained strength above the 1.3000 area before initiating positions on the long side. Above this area, 1.3035-40 might see some selling, but the pair could move to 1.3100. Further momentum might help bulls to take it to 1.3175-80 zone.

If the pair falls below 1.3000, then support could come at 1.2925 area and next at 1.2900. A fall below that means a fresh buying will be in play near 1.2875-65, restricting the slide. If the selling doesn’t subside near this area, then 1.2800 might give support before the pair falling to multi-week lows near 1.2765-60.