- Pound (GBP) is under pressure after consumer prices increase just +0.2% YoY

- BoE are under increasing pressure to act

- Australian Dollar (AUD) is supported by vaccine optimism

- Unemployment is expected to rise +7.8%

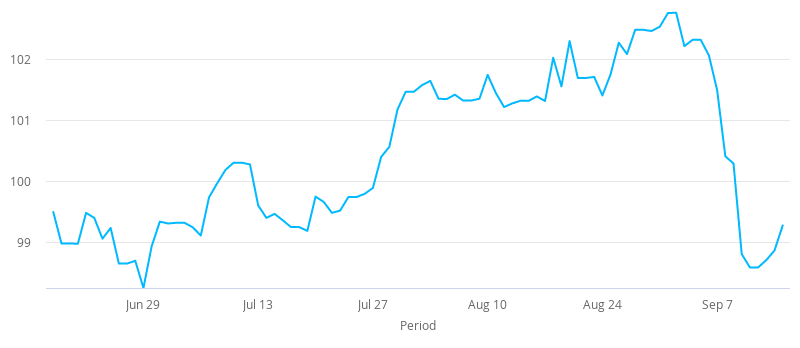

The Pound Australian (GBP/AUD) Dollar exchange rate is trading lower on Wednesday, snapping two days of wins. The pair settled in the previous session +0.2% at 1.7645. At 08:30 UTC, GBP/AUD trades -0.2% at 1.7613.

UK inflation fell sharply in August to +0.2% compared to the same period the previous year, although this was slightly better than forecast. This marked a sharp decline from the 1% increase recorded in July and was the lowest rate of inflation in four years.

The steep fall in inflation was partly due to the Chancellor’s Eat Out to Help Out scheme, with discounted meal prices weighing on inflation. Prices in restaurants and hotels fell -2.8% in August year on year. Air fares also registered a contraction in price, the first since records began. The data adds pressure to the Bank of England to ease policy further over the coming months.

The Bank of England will announce their monetary policy decision tomorrow. No changes are expected this month. However, there is growing expectation that the central bank will make a move in November amid depressed activity, the end of the governments job retention scheme and anaemic inflation.

The Australian Dollar is finding support from a mildly upbeat mood in the market. Vaccine optimism continues to underpin risk sentiment. China’s Centre for Disease Control and Prevention (CDC) announced that a vaccine could be given to Chinese citizens as soon as November. The news is driving demand for the Aussie Dollar, also known as a China proxy.

China currently has four the world’s 8 vaccine candidates which are in the final stage of testing. Clinical trials in China are reportedly proceeding smoothly.

Looking ahead Australian labour market data will be in focus. Analysts are expecting the unemployment rate t o continue to tick higher to 7.8%, up from 7.5%. The Reserve Bank of Australia sees unemployment reaching 10% in the coming months.