- UK inflation +0.2% YoY vs +0% forecast

- Unemployment data painted a mixed picture on Tuesday

- US Dollar (USD) looks to retail sales and FOMC rate decision

- No changes to policy expected by Fed

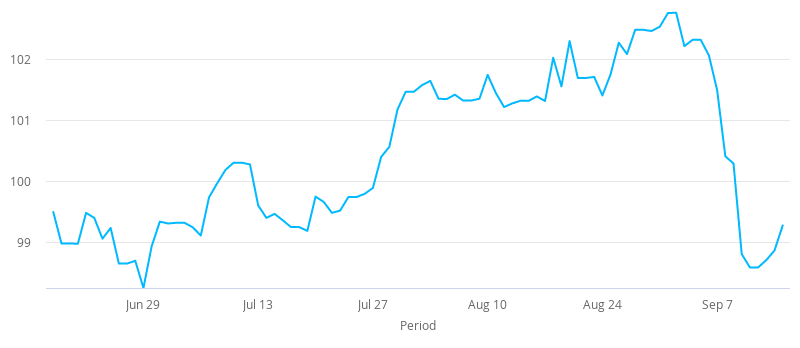

The Pound US Dollar (GBP/USD) exchange rate is trading cautiously higher, adding to gains from the previous two sessions. The pair settled on Tuesday +0.3% at US$1.2886. At 06:15 UTC, GBP/USD trades +0.1% just shy of US$1.29.

UK inflation, as measured by consumer prices, surprised to the upside, rising +0.2% YoY in August. This was better than the 0% forecast but still a steep decline from July’s 1% increase. Core inflation rose +0.9% in August compared to a year earlier, well down from last month’s +1.8% rise. However, this was still significantly better than the decade low of +0.6% increase which analysts had been expecting.

The data cones after mixed UK employment data. The unemployment rate in the UK rose to 4.2% in the three months to July, up from 3.9% in the three months to June. This was the first rise in unemployment since the coronavirus lockdown, as the Chancellor’s job retention scheme starts to wind down before expiring next month. Redundancies rose by over 48,000 to 156,000 which was the biggest jump in 10 years.

The US Dollar is trading on the back foot ahead of the Federal Reserve monetary policy announcement later today. The Fed is not expected to adjust monetary policy. Investors will be waiting for more clarification on the shift to Average inflation targeting, a change in policy framework announced by Federal Reserve Chair Jerome Powell at the Jackson Hole symposium last month.

The Fed will also release updated economic projections, which will include the dot plot – which maps out the Fed’s expectations for rates. The dot plot could be lowered to reflect the fact that the Fed will be allowing inflation to overshoot the 2% inflation target to make up from periods under the 2% level. This could drag on demand for the greenback.

Prior to the Fed’s announcement US retail sales are expected to rise 1.1% month on month in August, just slightly down from 1.2% the previous month.