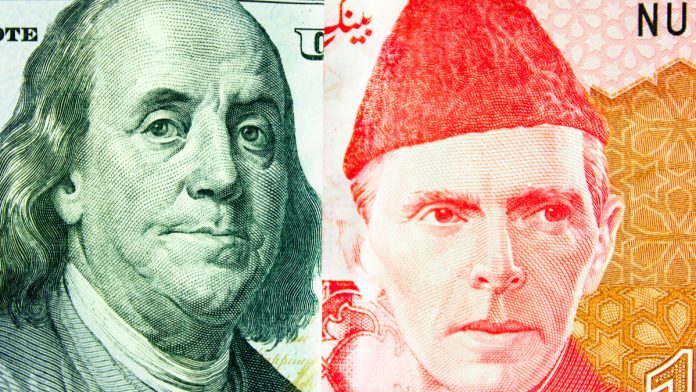

The Pakistani Rupee is declining against the mighty US dollar on Thursday. Demand for the US dollar is showing no signs of easing whilst emerging markets are in the fastest collapse in a generation. The Pakistani Rupee closed 0.1% lower versus the US Dollar at 158.50.

At 10:30 UTC, USD/PKR is trading at 159.20.

Safe Haven US Dollar Rises

Demand for the safe haven US dollar continue to build. The US Dollar is trading higher across the board, but particularly against riskier emerging market currencies. The rise in the dollar comes despite the Federal Reserve easing monetary policy considerably over the past few weeks through rate cuts and through pumping billions of dollars into the system.

With the coronavirus pandemic worsening across the globe and global markets experiencing wild swings, investors are panicking and rushing towards the safe haven US dollar. Even other traditional safe havens are struggling to advance alongside the greenback.

Hope that the US government will ramp up fiscal policy are also rising. President Trump, last night, signed a $100 billion coronavirus relief package guaranteeing 10 days paid leave and free testing for Americans impacted by the coronavirus pandemic. The Senate is also negotiating another bill worth up to $1 trillion or more to bolster the economy.

Pakistani Rupee Declines On Moody’s Warning

The Pakistani Rupee remains out of favour as investors continue to shun riskier currencies and assets and pull their money from Pakistan.

According to the State Bank of Pakistan (SNP) total gross divestment, money leaving the country, has reached $995 million during March. The general pattern of divestment started in late February as concerns over coronavirus increased and as foreign investors looked for safe alternatives for their money.

Rating agency Moody’s did little to support demand for the Pakistani Rupee after painting a gloomy picture for the Pakistan economy amid the coronavirus spread. Moody’s said that Pakistani government might be constrained by already high indebtedness and limited access to funding to combat the coronavirus pandemic. An intensification of the breakout will cause significant economic weakening and slowing domestic consumption.