- GBP/USD trades near the highest level since early March

- The policy announcements were in line with expectations

- BOE’s economic expectations are slightly optimistic than earlier

BOE policy announcements were line with expectations of no change in policy rates; also, there were no indications regarding the extension of quantitative easing or any immediate move towards negative interest rates. QE extension and inclination for negative-interest would have been negative for the Sterling; GBP/USD rallied immediately after the announcement.

In March, the central bank had cut key interest rate to 0.10 Percent and added 200 billion pounds in its QE program – now at 645 billion pounds.

Analysts had expected that the BOE would consider the recent economic improvements to keep the status quo in its policy announcements. Governor Bailey’s press conference and the economic projections from the bank wouldn’t throw any positive surprise in terms of the near-term direction of the economy, analysts agree.

Before the BOE, the Cable showed mild gains of 0.12 Percent today after a two-day increase to 1.3130. It was trading near the highest level since March, posted on Friday, heading into the UK trading. The bears would have made some impression today if the pair had failed to cross the resistance at 1.3170, part of a downward sloping trend line since January 31, 2020; the RSI was also in overbought range.

With BOE pressure off its shoulders, if bulls continue the momentum, GBP/USD might target December 31, 2019 peak of 1.3285 after crossing psychologically important 1.3200 and late-January top of 1.3210.

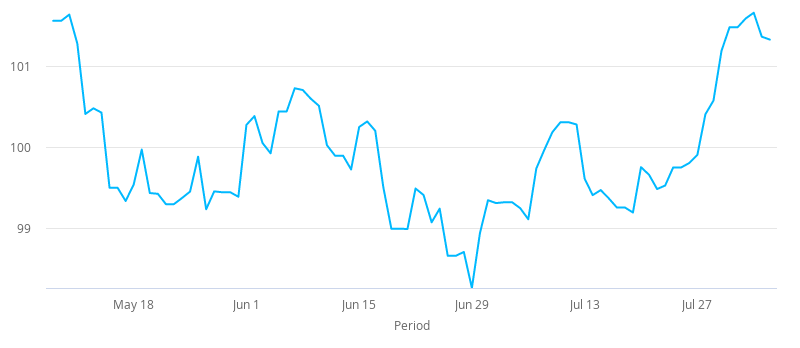

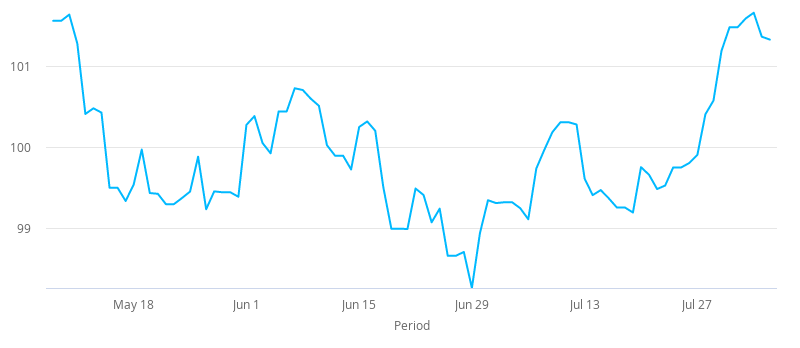

GBP Index Today - last 90 days

Currency Index charts show the

strength of a single currency based on a basket of foreign currencies. This is done using a weighted mean (an average) of the 5 largest routes from that source currency and their daily FX rates. You can explore

live exchange rates here.

Currencylive.com is a news site only and not a currency trading platform. Currencylive.com is a site operated by Wise US Inc ("We", "Us"), a Delaware Corporation. We do not guarantee that the website will operate in an uninterrupted or error-free manner or is free of viruses or other harmful components. The content on our site is provided for general information only and is not intended as an exhaustive treatment of its subject. We expressly disclaim any contractual or fiduciary relationship with you on the basis of the content of our site, any you may not rely thereon for any purpose. You should consult with qualified professionals or specialists before taking, or refraining from, any action on the basis of the content on our site. Although we make reasonable efforts to update the information on our site, we make no representations, warranties or guarantees, whether express or implied, that the content on our site is accurate, complete or up to date, and DISCLAIM ANY IMPLIED WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE. Some of the content posted on this site has been commissioned by Us, but is the work of independent contractors. These contractors are not employees, workers, agents or partners of Wise and they do not hold themselves out as one. The information and content posted by these independent contractors have not been verified or approved by Us. The views expressed by these independent contractors on currencylive.com do not represent our views.