- Euro strengthens against the dollar after a brief pullback

- Dollar struggles with growth concerns and fiscal impass

- Market eyes Final Eurozone Services PMI, ADP report and the US ISM PMI

The EUR/USD pair has now managed to shrug-off the start-of-the-week weakness and managed to attract buyers; bouncing back from below 1.1700 levels on Monday, it had climbed up further on Tuesday.

The up-move was helped by the continued weakness in the US dollar, despite the US ISM Manufacturing PMI beating expectations; subdued hopes of a US economic recovery checked bullishness in the greenback.

The congressional impasse over the US fiscal stimulus and the recent drop in the treasury-bond yields also cut the long positions in the US dollar.

The US lawmakers had failed to agree on the details of a new coronavirus relief package despite the earlier unemployment benefit expiring last Friday. Whitehouse and congressional Democrats are working around the clock to nail-a-deal before the end of this week, reports suggest. It is also important to note that the US Treasury Secretary Steven Mnuchin hinted that the deal, if any, would be much less than 3.4 trillion dollars sought by the Democrats.

EUR/USD is trading higher today in the Asian session, around 1.1800 marks. Traders will be eyeing the Final Eurozone Services PMI for further clarity; later, in the US trading hours, the ADP report on private-sector employment and ISM Non-Manufacturing PMI will help to set the tone for the pair.

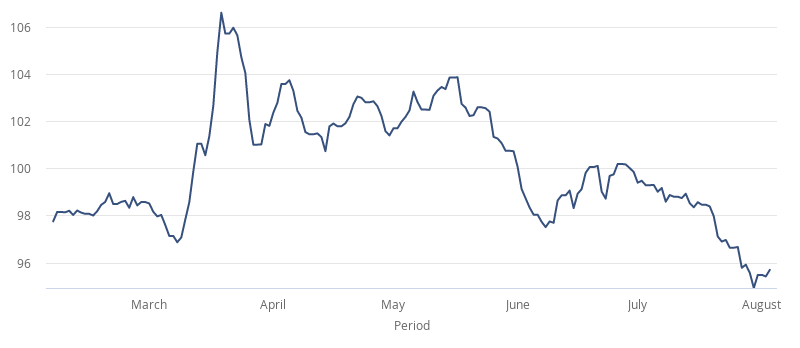

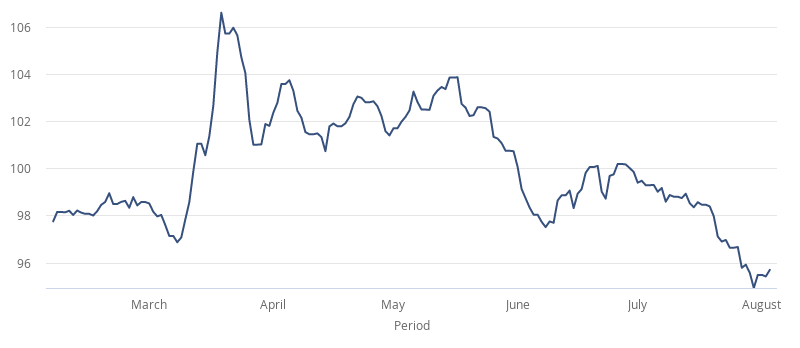

USD Index Today - last 180 days

Currency Index charts show the

strength of a single currency based on a basket of foreign currencies. This is done using a weighted mean (an average) of the 5 largest routes from that source currency and their daily FX rates. You can explore

live exchange rates here.

Currencylive.com is a news site only and not a currency trading platform. Currencylive.com is a site operated by Wise US Inc ("We", "Us"), a Delaware Corporation. We do not guarantee that the website will operate in an uninterrupted or error-free manner or is free of viruses or other harmful components. The content on our site is provided for general information only and is not intended as an exhaustive treatment of its subject. We expressly disclaim any contractual or fiduciary relationship with you on the basis of the content of our site, any you may not rely thereon for any purpose. You should consult with qualified professionals or specialists before taking, or refraining from, any action on the basis of the content on our site. Although we make reasonable efforts to update the information on our site, we make no representations, warranties or guarantees, whether express or implied, that the content on our site is accurate, complete or up to date, and DISCLAIM ANY IMPLIED WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE. Some of the content posted on this site has been commissioned by Us, but is the work of independent contractors. These contractors are not employees, workers, agents or partners of Wise and they do not hold themselves out as one. The information and content posted by these independent contractors have not been verified or approved by Us. The views expressed by these independent contractors on currencylive.com do not represent our views.